Grundlæggende statistik

| Porteføljeværdi | $ 433.637.726 |

| Nuværende stillinger | 646 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

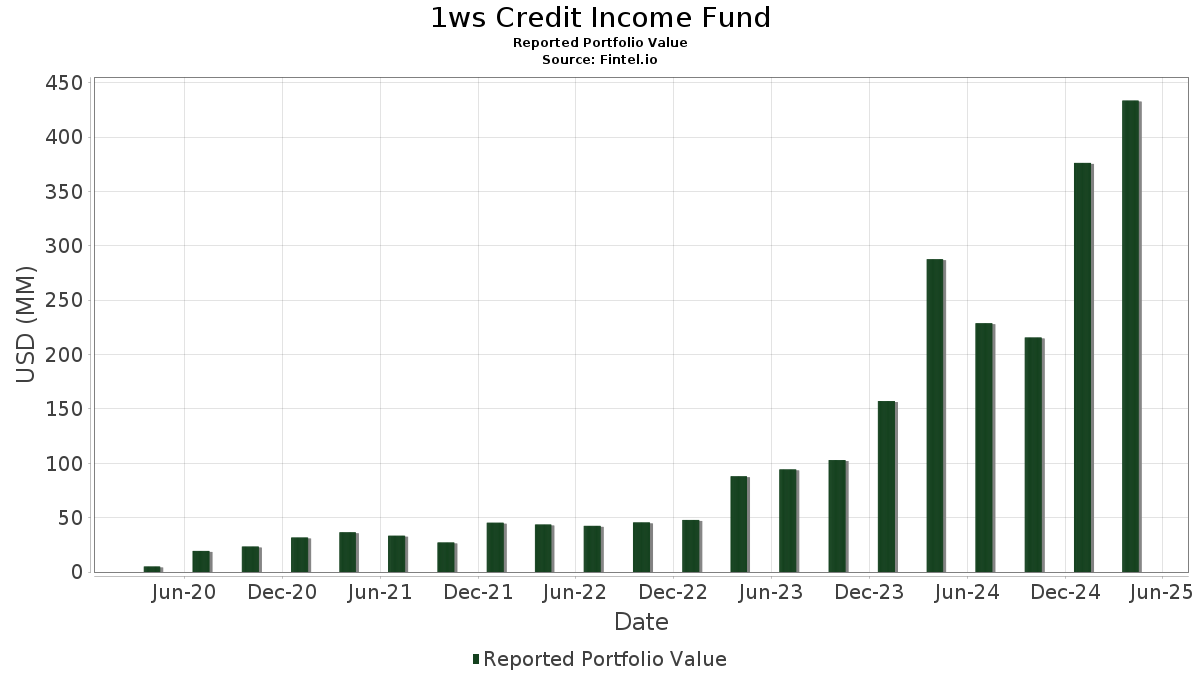

1ws Credit Income Fund har afsløret 646 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 433.637.726 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). 1ws Credit Income Funds største beholdninger er BlackRock Liquidity Funds: T-Fund, Institutional Shares (US:US09248U7182) , Exeter Automobile Receivables Trust, Series 2022-4A, Class E (US:US30166BAG77) , BLACKROCK TREASURY TRUST 062 (US:US09248U5517) , COMM MORTGAGE TRUST COMM 2021 2400 B 144A (US:US20048FAG37) , and CAS_21-R02 (US:US20754KAJ07) . 1ws Credit Income Funds nye stillinger omfatter Exeter Automobile Receivables Trust, Series 2022-4A, Class E (US:US30166BAG77) , COMM MORTGAGE TRUST COMM 2021 2400 B 144A (US:US20048FAG37) , CAS_21-R02 (US:US20754KAJ07) , Banc of America Re-Remic Trust (US:US05493LAG14) , and Exeter Automobile Receivables Trust 2022-6 (US:US30168AAG76) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 24,69 | 4,2546 | 4,2546 | ||

| 19,74 | 3,4026 | 3,4026 | ||

| 9,99 | 1,7219 | 1,7219 | ||

| 9,96 | 1,7167 | 1,7167 | ||

| 9,94 | 1,7124 | 1,7124 | ||

| 9,90 | 1,7055 | 1,7055 | ||

| 8,06 | 1,3890 | 1,3890 | ||

| 5,52 | 0,9515 | 0,9515 | ||

| 5,28 | 0,9094 | 0,9094 | ||

| 5,00 | 0,8617 | 0,8617 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -63,30 | -10,9089 | -10,9089 | ||

| -38,02 | -6,5529 | -6,5529 | ||

| 0,00 | 0,00 | -4,8835 | ||

| -15,40 | -2,6544 | -2,6544 | ||

| -11,14 | -1,9194 | -1,9194 | ||

| 40,46 | 40,46 | 6,9731 | -1,1179 | |

| -5,45 | -0,9385 | -0,9385 | ||

| -3,32 | -0,5730 | -0,5730 | ||

| 0,75 | 0,1300 | -0,5658 | ||

| 0,65 | 0,1121 | -0,5224 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-27 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 40,46 | -2,35 | 40,46 | -2,35 | 6,9731 | -1,1179 | |||

| FIGRE Trust, Series 2025-HE2, Class A / ABS-MBS (US31684KAA16) | 24,69 | 4,2546 | 4,2546 | ||||||

| United States Treasury Bill / DBT (US912797QK68) | 19,74 | 3,4026 | 3,4026 | ||||||

| United States Treasury Bill / DBT (US912797NE36) | 9,99 | 1,7219 | 1,7219 | ||||||

| United States Treasury Bill / DBT (US912797PL50) | 9,96 | 1,7167 | 1,7167 | ||||||

| United States Treasury Bill / DBT (US912797PT86) | 9,94 | 1,7124 | 1,7124 | ||||||

| United States Treasury Bill / DBT (US912797QC43) | 9,90 | 1,7055 | 1,7055 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class A / ABS-MBS (US922955AA73) | 8,06 | 1,3890 | 1,3890 | ||||||

| RRRR Repo Funding Trust, Series 2025-1 Pass-Through Certificates / ABS-O (US78108CAA80) | 5,52 | 0,9515 | 0,9515 | ||||||

| Pagaya AI Debt Trust, Series 2024-3, Class E / ABS-O (US69547XAE22) | 5,52 | 0,67 | 0,9514 | -0,1193 | |||||

| Pagaya AI Debt Grantor Trust, Series 2025-2, Class E / ABS-O (US69548YAA73) | 5,28 | 0,9094 | 0,9094 | ||||||

| Matthew R. Stubbs, LLC, Tranche B Facility Interest / DBT (N/A) | 5,00 | 0,8617 | 0,8617 | ||||||

| US30166BAG77 / Exeter Automobile Receivables Trust, Series 2022-4A, Class E | 4,66 | 56,94 | 0,8033 | 0,2232 | |||||

| BBAM US CLO I, Ltd., Series 2025-1A, Class AR / ABS-CBDO (US054978AL59) | 3,87 | 0,6677 | 0,6677 | ||||||

| NYMT 2024-BPL2 M / ABS-MBS (US67120TAC45) | 3,86 | 2,53 | 0,6645 | -0,0698 | |||||

| Bridge Street CLO V, Ltd., Series 2025-1A, Class A1 / ABS-CBDO (US107921AA64) | 3,74 | 0,6438 | 0,6438 | ||||||

| US09248U5517 / BLACKROCK TREASURY TRUST 062 | 3,54 | 23,32 | 3,54 | 23,32 | 0,6106 | 0,0496 | |||

| Kinbane 2022-RPL 1 DAC, Series 2022-RPL1X, Class E / ABS-MBS (XS2499839855) | 3,51 | 0,6046 | 0,6046 | ||||||

| Polaris PLC, Series 2025-1, Class X / ABS-MBS (XS2984151436) | 3,32 | 0,5716 | 0,5716 | ||||||

| GRDN 2024-1 B / ABS-O (BCC3JLXT8) | 3,32 | 1,94 | 0,5714 | -0,0637 | |||||

| MARKIT CDX HY S44 5Y 6/30 ICE / DCR (N/A) | 3,29 | 0,5670 | 0,5670 | ||||||

| US20048FAG37 / COMM MORTGAGE TRUST COMM 2021 2400 B 144A | 3,27 | 0,18 | 0,5639 | -0,0739 | |||||

| BriteCap SPV 3 LLC, Loan Facility / DBT (N/A) | 3,26 | 0,5616 | 0,5616 | ||||||

| Voya CLO 2019-4, Ltd., Series 2021-4A, Class ER / ABS-CBDO (US92917UAE29) | 3,16 | 0,5438 | 0,5438 | ||||||

| Exeter Automobile Receivables Trust 2025-1, Series 2025-1A, Class E / ABS-O (US30167MAG24) | 3,14 | 3,53 | 0,5411 | -0,0510 | |||||

| Upgrade Receivables Trust 2024-1, Series 2024-1A, Class D / ABS-O (US91533NAD66) | 3,09 | 303,13 | 0,5322 | 0,3825 | |||||

| Small Business Origination Loan Trust DAC, Series 2025-1, Class C / ABS-O (XS3045381046) | 3,08 | 0,5316 | 0,5316 | ||||||

| Kinbane 2024-Rpl 2 DAC, Series 2024-RPL2X, Class F / ABS-MBS (XS2929504541) | 3,07 | 6,78 | 0,5293 | -0,0322 | |||||

| US20754KAJ07 / CAS_21-R02 | 3,06 | -1,67 | 0,5276 | -0,0804 | |||||

| Exeter Automobile Receivables Trust 2025-2, Series 2025-2A, Class E / ABS-O (US30168JAG85) | 3,04 | 0,5248 | 0,5248 | ||||||

| Shackleton 2013-IV-R CLO, Ltd., Series 2018-4RA, Class D / ABS-CBDO (US81882GAA58) | 3,04 | 127,79 | 0,5242 | 0,2634 | |||||

| US05493LAG14 / Banc of America Re-Remic Trust | 3,02 | 2,37 | 0,5205 | -0,0557 | |||||

| US30168AAG76 / Exeter Automobile Receivables Trust 2022-6 | 2,88 | -0,69 | 0,4960 | -0,0701 | |||||

| US69547UAD00 / PAGAYA AI DEBT TST. 9.00% | 2,79 | 0,18 | 0,4804 | -0,0629 | |||||

| RSD FUNDING 2025, LLC, Participation Interest / DBT (RSD000003) | 2,77 | 0,4782 | 0,4782 | ||||||

| US35565KBE73 / Freddie Mac STACR Remic Trust 2020-DNA2 | 2,75 | -1,99 | 0,4743 | -0,0740 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,75 | -0,94 | 0,4738 | -0,0682 | |||||

| US78458MAJ36 / SMR 2022-IND Mortgage Trust | 2,73 | -0,47 | 0,4713 | -0,0652 | |||||

| Cardiff Auto Receivables Securitisation PLC, Series 2024-1, Class E / ABS-O (XS2866378685) | 2,65 | 6,78 | 0,4561 | -0,0278 | |||||

| United Auto Credit Securitization Trust, Series 2024-1, Class E / ABS-O (US90945DAE04) | 2,64 | 7,59 | 0,4543 | -0,0241 | |||||

| PRET LLC, Series 2025-NPL3, Class A1 / ABS-MBS (US74143HAA32) | 2,63 | 0,4529 | 0,4529 | ||||||

| Pagaya AI Debt Trust, Series 2024-1, Class E / ABS-O (US69548AAE10) | 2,53 | 1,52 | 0,4362 | -0,0506 | |||||

| Pagaya AI Debt Trust, Series 2023-8, Class E / ABS-O (US694960AE51) | 2,53 | 1,48 | 0,4360 | -0,0507 | |||||

| Vibrant CLO IX-R, Ltd., Series 2025-9RA, Class A1 / ABS-CBDO (US92557BAA70) | 2,52 | 0,4344 | 0,4344 | ||||||

| Pagaya AI Debt Trust, Series 2022-2, Class C / ABS-O (US69546VAC19) | 2,50 | 1,42 | 0,4304 | -0,0505 | |||||

| US35565MBE30 / CORP CMO | 2,40 | -1,88 | 0,4144 | -0,0640 | |||||

| Vontive Mortgage Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US928884AA35) | 2,39 | 0,4126 | 0,4126 | ||||||

| US61765TAP84 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C25 | 2,38 | 344,67 | 0,4100 | 0,3056 | |||||

| Kinbane 2022-RPL 1 DAC, Series 2022-RPL1X, Class F / ABS-MBS (XS2499840192) | 2,32 | 0,3991 | 0,3991 | ||||||

| US05493LAJ52 / BAMLL COML MTG SECS TR 2021-JACX 1ML+200 09/15/2038 144A | 2,23 | 14,34 | 0,3848 | 0,0035 | |||||

| VCP Tyler Pref, LLC / ABS-MBS (N/A) | 2,22 | 0,3820 | 0,3820 | ||||||

| US75525AAD72 / Reach ABS Trust 2023-1, Series 2023-1A, Class D | 2,17 | 2,31 | 0,3742 | -0,0403 | |||||

| Carvana Auto Receivables Trust, Series 2023-N4, Class E / ABS-O (US14688LAE39) | 2,17 | 8,99 | 0,3738 | -0,0148 | |||||

| GLS Auto Receivables Issuer Trust 2025-1, Series 2025-1A, Class E / ABS-O (US36271KAN19) | 2,16 | 0,3731 | 0,3731 | ||||||

| Steele Creek CLO 2022-1, Ltd., Series 2025-1A, Class DR / ABS-CBDO (US85816FAY79) | 2,15 | 0,3714 | 0,3714 | ||||||

| Kinbane 2025-RPL1 DAC, Series 2025-RPL1X, Class D / ABS-MBS (XS3009458723) | 2,15 | 0,3709 | 0,3709 | ||||||

| US86361CAF23 / SASC 2006-W1A M1 | 2,15 | 9,20 | 0,3705 | -0,0138 | |||||

| US30167FAG72 / Exeter Automobile Receivables Trust 2022-5, Series 2022-5A, Class E | 2,07 | -1,89 | 0,3571 | -0,0554 | |||||

| US69546PAD24 / PAGAYA AI DEBT TRUST 2023 5 | 2,06 | -41,68 | 0,3558 | -0,3354 | |||||

| Arivo Acceptance Auto Loan Receivables Trust 2024-1, Series 2024-1A, Class D / ABS-O (US039943AD78) | 2,06 | 45,47 | 0,3545 | 0,0782 | |||||

| US76088TAC53 / Research-Driven Pagaya Motor Asset Trust VII | 2,05 | -0,49 | 0,3533 | -0,0489 | |||||

| GAMMA Sociedade de Titularizacao de Creditos, Series 2024-2, Class E / ABS-O (PTGAMQOM0016) | 2,04 | 9,25 | 0,3524 | -0,0131 | |||||

| FIGRE Trust, Series 2025-HE1, Class A / ABS-MBS (US30191LAA70) | 2,04 | 72,70 | 0,3521 | 0,1211 | |||||

| US20048GAA40 / COMM 2019-521F Mortgage Trust | 2,03 | 0,00 | 0,3504 | -0,0468 | |||||

| Upgrade Master Pass-Thru Trust, Series 2025-P1, Class CERT / ABS-O (US91533LAB45) | 2,03 | 0,3492 | 0,3492 | ||||||

| US00461VAD55 / ACM Auto Trust 2023-1, Series 2023-1A, Class D | 2,02 | -23,74 | 0,3476 | -0,1689 | |||||

| US35566CBE49 / FHLMC STACR REMIC Trust, Series 2020-DNA6, Class B2 | 2,02 | -2,94 | 0,3476 | -0,0582 | |||||

| DBWF, Series 2024-LCRS Mortgage Trust, Class E / ABS-MBS (US23307KAJ60) | 2,00 | -0,20 | 0,3448 | -0,0465 | |||||

| Wilmot Plaza Mezz Loan, Class F / ABS-MBS (N/A) | 2,00 | 0,3447 | 0,3447 | ||||||

| Pagaya AI Debt Grantor Trust, Series 2024-10, Class E / ABS-O (US69546UAA79) | 2,00 | -2,54 | 0,3438 | -0,0560 | |||||

| Kinbane 2025-RPL1 DAC, Series 2025-RPL1X, Class E / ABS-MBS (XS3009459028) | 1,98 | 0,3410 | 0,3410 | ||||||

| Sandpiper Funding 2023, LLC, Participation Interest / DBT (N/A) | 1,97 | 0,3402 | 0,3402 | ||||||

| US90944DAJ00 / UNITED AUTO CREDIT 11/10/2028 5% | 1,97 | -11,25 | 0,3386 | -0,0938 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,96 | -1,21 | 0,3377 | -0,0496 | |||||

| Pagaya AI Debt Grantor Trust, Series 2024-8, Class F / ABS-O (US69548PAB40) | 1,94 | 1,46 | 0,3350 | -0,0390 | |||||

| US63543TAJ79 / National Collegiate Student Loan Trust, Class B | 1,94 | -6,77 | 0,3347 | -0,0721 | |||||

| Apidos CLO XXIII, Series 2025-23A, Class CRR / ABS-CBDO (US03765YBL74) | 1,93 | 0,3319 | 0,3319 | ||||||

| XS0266256709 / EUROSAIL PLC ESAIL 2006 2X D1C REGS | 1,90 | 36,69 | 0,3276 | 0,0561 | |||||

| US63875LAA17 / Natixis Commercial Mortgage Securities Trust 2022-JERI | 1,89 | -1,10 | 0,3257 | -0,0475 | |||||

| US05493LAQ95 / BAMLL Commercial Mortgage Securities Trust 2021-JACX | 1,89 | 3,68 | 0,3251 | -0,0302 | |||||

| Upstart Securitization Trust, Series 2024-1, Class C / ABS-O (US91684NAC56) | 1,87 | 0,05 | 0,3226 | -0,0427 | |||||

| Exeter Automobile Receivables Trust 2024-2, Series 2024-2A, Class E / ABS-O (US30166DAG34) | 1,81 | 0,28 | 0,3117 | -0,0404 | |||||

| US055287AA48 / BBSG 2016-MRP Mortgage Trust | 1,80 | 0,3105 | 0,3105 | ||||||

| US33843XAG43 / Flagship Credit Auto Trust, Series 2022-4, Class E | 1,79 | -3,30 | 0,3080 | -0,0530 | |||||

| Radnor Re, Ltd., Series 2024-1, Class M1B / ABS-MBS (US75049AAB89) | 1,75 | 220,66 | 0,3023 | 0,1954 | |||||

| Pagaya AI Debt Grantor Trust, Series 2024-11, Class E / ABS-O (US69548EAA10) | 1,69 | -1,11 | 0,2914 | -0,0423 | |||||

| Bullock Legal Group, Loan Facility / DBT (N/A) | 1,69 | 0,2905 | 0,2905 | ||||||

| Auto ABS Spanish Loans FT, Series 2024-1, Class D / ABS-O (ES0305837033) | 1,68 | 3,51 | 0,2896 | -0,0275 | |||||

| Jeronimo Funding DAC, Series 2025-1, Class B / ABS-MBS (XS2956118637) | 1,67 | 8,08 | 0,2882 | -0,0139 | |||||

| Tricolor Auto Securitization Trust 2025-1, Series 2025-1A, Class D / ABS-O (US89617CAD39) | 1,67 | 0,2876 | 0,2876 | ||||||

| US00161AAB89 / ACM AUTO TRUST | 1,64 | -13,24 | 0,2824 | -0,0863 | |||||

| Dowson PLC, Series 2024-1, Class F / ABS-O (XS2919894381) | 1,64 | 7,07 | 0,2818 | -0,0164 | |||||

| NewDay Funding, Series 2022-3A, Class E / ABS-O (XS2554989918) | 1,61 | 5,78 | 0,2775 | -0,0198 | |||||

| US14688FAF36 / CARVANA AUTO RECEIVABLES TRUST 2023-N1 CRVNA 2023-N1 E | 1,59 | -2,57 | 0,2742 | -0,0449 | |||||

| US20754DAJ63 / Connecticut Avenue Securities Trust 2022-R05 | 1,57 | 293,72 | 0,2701 | 0,1924 | |||||

| US83611MJM10 / SVHE 2005-OPT4 M2 | 1,56 | 1,96 | 0,2695 | -0,0300 | |||||

| US12664LAE56 / CPS Auto Receivables Trust, Series 2023-A, Class E | 1,54 | 1,72 | 0,2654 | -0,0303 | |||||

| Avant Loans Funding Trust, Series 2025-REV1, Class D / ABS-O (US05352BAD01) | 1,51 | 0,2607 | 0,2607 | ||||||

| Pagaya AI Debt Grantor Trust, Series 2025-3, Class E / ABS-O (US69547GAA76) | 1,51 | 0,2596 | 0,2596 | ||||||

| US05493HAA32 / BBCMS Trust | 1,50 | 0,33 | 0,2590 | -0,0336 | |||||

| CFG Investments, Ltd., Series 2025-1, Class B / ABS-O (US12528GAN25) | 1,50 | 0,2588 | 0,2588 | ||||||

| Affirm Asset Securitization Trust, Series 2024-A, Class 1E / ABS-O (US00834BAK35) | 1,50 | -2,41 | 0,2582 | -0,0417 | |||||

| Kinbane 2025-RPL1 DAC, Series 2025-RPL1X, Class C / ABS-MBS (XS3009458566) | 1,50 | 0,2577 | 0,2577 | ||||||

| JW Trust, Series 2024-BERY, Class E / ABS-MBS (US46676AAJ25) | 1,49 | -1,72 | 0,2563 | -0,0392 | |||||

| TAGUS-Sociedade de Titularizacao de Creditos SA/Vasco Finance No. 2, Series 2024-2, Class D / ABS-O (PTTGCEOM0029) | 1,48 | 8,57 | 0,2556 | -0,0112 | |||||

| US26982EAG17 / Eagle RE 2023-1 Ltd | 1,47 | 37,68 | 0,2532 | 0,0447 | |||||

| Kinbane 2024-Rpl 2 DAC, Series 2024-RPL2X, Class E / ABS-MBS (XS2929504038) | 1,46 | 9,13 | 0,2513 | -0,0097 | |||||

| Hops Hill No2 PLC, Series 2022-2, Class E / ABS-MBS (XS2488937025) | 1,45 | 6,87 | 0,2492 | -0,0150 | |||||

| XS2607788382 / Castell PLC, Series 2023-1, Class G | 1,42 | 175,44 | 0,2454 | 0,1443 | |||||

| Tricolor Auto Securitization Trust 2024-3, Series 2024-3A, Class E / ABS-O (US89617AAE55) | 1,42 | -1,59 | 0,2449 | -0,0371 | |||||

| Marble Point CLO XVIII, Ltd., Series 2025-2A, Class D2R2 / ABS-CBDO (US566076BN43) | 1,40 | 0,2414 | 0,2414 | ||||||

| Homeward Opportunities Fund Trust, Series 2025-RRTL1, Class M1 / ABS-MBS (US437919AE32) | 1,39 | 0,2403 | 0,2403 | ||||||

| GoodLeap Home Improvement Solutions Trust 2025-1, Series 2025-1A, Class C / ABS-O (US38237EAC84) | 1,39 | -0,71 | 0,2399 | -0,0340 | |||||

| US32027NXY20 / First Franklin Mortgage Loan Trust, Class M3 | 1,39 | 8,27 | 0,2391 | -0,0111 | |||||

| US91683KAB44 / Upstart Pass-Through Trust, Series 2021-ST7, Class CERT | 1,39 | -20,22 | 0,2388 | -0,1003 | |||||

| Oportun Issuance Trust, Series 2025-A, Class D / ABS-O (US68377TAD00) | 1,37 | -1,58 | 0,2362 | -0,0356 | |||||

| Reach Consumer 2022-1, LLC, Class B Facility / DBT (REACHCAP1) | 1,37 | 503,52 | 0,2361 | 0,1917 | |||||

| SWF Funding LLC, Loan Facility / DBT (N/A) | 1,36 | 0,2351 | 0,2351 | ||||||

| Pagaya Ai Debt Grantor Trust, Series 2024-9, Class F / ABS-O (US69548QAB23) | 1,36 | 0,96 | 0,2347 | -0,0287 | |||||

| PRPM LLC, Series 2025-2, Class A1 / ABS-MBS (US69382HAA32) | 1,36 | 0,2344 | 0,2344 | ||||||

| US040104QQ78 / Argent Securities Inc Asset-Backed Pass-Through Certificates Series 2005-W5 | 1,36 | 5,03 | 0,2340 | -0,0183 | |||||

| Research-Driven Pagaya Motor Asset Trust 2025-1, Series 2025-1A, Class D / ABS-O (US76100AAA43) | 1,36 | 0,2336 | 0,2336 | ||||||

| US30166YAG70 / EART_22-3A | 1,35 | -3,58 | 0,2324 | -0,0408 | |||||

| Tricolor Auto Securitization Trust 2024-3, Series 2024-3A, Class F / ABS-O (US89617AAF21) | 1,33 | 1,29 | 0,2298 | -0,0274 | |||||

| Upgrade Receivables Trust 2024-1, Series 2024-1A, Class E / ABS-O (US91533NAE40) | 1,33 | 0,00 | 0,2295 | -0,0305 | |||||

| US91679AAC09 / Upstart Securitization Trust 2023-1 | 1,28 | 0,79 | 0,2212 | -0,0276 | |||||

| Santander Consumer Finance SA/NOMA, Series 2023-1, Class B / ABS-O (XS2725960004) | 1,28 | -1,54 | 0,2209 | -0,0333 | |||||

| US52521RBR12 / Lehman Mortgage Trust, Series 2007-5 Class 6A1 | 1,28 | -11,02 | 0,2199 | -0,0601 | |||||

| FIGRE Trust, Series 2025-PF1, Class A / ABS-MBS (US316922AA11) | 1,28 | 0,2198 | 0,2198 | ||||||

| US17290YAC21 / Citigroup Commercial Mortgage Trust, Series 2016-C1, Class E | 1,27 | 2,67 | 0,2184 | -0,0225 | |||||

| US05493LAN64 / BAMLL COML MTG SECS TR 2021-JACX E 1ML+375 09/15/2038 144A | 1,25 | 0,2159 | 0,2159 | ||||||

| Crown Point CLO 11, Ltd., Series 2025-11A, Class D2R / ABS-CBDO (US22845JAW18) | 1,25 | 0,2148 | 0,2148 | ||||||

| US63860LAG59 / NSTR 2007-B M2 MTGE | 1,23 | 4,31 | 0,2126 | -0,0183 | |||||

| Carvana Auto Receivables Trust, Series 2024-N3, Class E / ABS-O (US14687WAG50) | 1,23 | 0,16 | 0,2122 | -0,0279 | |||||

| Brants Bridge PLC, Series 2023-1, Class E / ABS-MBS (XS2642405737) | 1,23 | 6,97 | 0,2115 | -0,0125 | |||||

| Pagaya AI Debt Grantor Trust, Series 2024-8, Class E / ABS-O (US69548PAA66) | 1,22 | 1,24 | 0,2105 | -0,0251 | |||||

| Brignole CQ, Series 2024-2024, Class X / ABS-O (IT0005612350) | 1,22 | -12,68 | 0,2102 | -0,0626 | |||||

| IT0005561318 / Golden Bar Securitisation Srl, Series 2023-2, Class E | 1,22 | -1,93 | 0,2099 | -0,0326 | |||||

| Pagaya Ai Debt Grantor Trust, Series 2024-9, Class E / ABS-O (US69548QAA40) | 1,21 | -0,82 | 0,2087 | -0,0299 | |||||

| Genesis Mortgage Funding PLC, Series 2022-1, Class F / ABS-MBS (XS2448431077) | 1,21 | 0,2080 | 0,2080 | ||||||

| US86358EYG50 / Structured Asset Investment Loan Trust 2005-9 | 1,21 | 4,78 | 0,2078 | -0,0169 | |||||

| US05549GAL59 / BHMS_18-ATLS | 1,20 | 0,00 | 0,2070 | -0,0276 | |||||

| US05493HAQ83 / BBCMS, Series 2021-AGW Mortgage Trust, Class F | 1,19 | 1,11 | 0,2046 | -0,0248 | |||||

| United Auto Credit Securitization Trust, Series 2025-1, Class E / ABS-O (US90945JAE73) | 1,17 | 0,2020 | 0,2020 | ||||||

| US94989VBB45 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class E | 1,17 | 2,72 | 0,2020 | -0,0208 | |||||

| Mortimer 2024-Mix PLC, Series 2024-MIX, Class E / ABS-MBS (XS2920414203) | 1,15 | 13,24 | 0,1977 | 0,0000 | |||||

| LHOME Mortgage Trust, Series 2025-RTL2, Class A1 / ABS-MBS (US50206RAA59) | 1,14 | 0,1966 | 0,1966 | ||||||

| US46625SAG12 / JP Morgan Mortgage Acquisition Trust, Class M2 | 1,14 | 2,71 | 0,1957 | -0,0202 | |||||

| US35565RBE27 / STACR 2020-HQA4 B2 | 1,12 | -1,58 | 0,1937 | -0,0294 | |||||

| MARKIT CDX IG S44 5Y 6/30 ICE / DCR (N/A) | 1,12 | 0,1934 | 0,1934 | ||||||

| US12595KAA97 / CSMC Trust 2017-PFHP | 1,11 | -4,31 | 0,1914 | -0,0352 | |||||

| Pagaya AI Debt Trust, Series 2024-3, Class D / ABS-O (US69547XAD49) | 1,11 | -23,76 | 0,1914 | -0,0930 | |||||

| Towd Point Mortgage Funding 2024 - Granite 6 PLC, Series 2024-GR6X, Class E / ABS-MBS (XS2799790444) | 1,11 | 7,05 | 0,1912 | -0,0113 | |||||

| Cherry SPV III (2023) LLC, Class B Facility / DBT (N/A) | 1,10 | 0,1903 | 0,1903 | ||||||

| WCORE Commercial Mortgage Trust, Series 2024-CORE, Class E / ABS-MBS (US951913AJ17) | 1,10 | -1,52 | 0,1899 | -0,0285 | |||||

| Jonas Catalog Holdings I, LLC, Term Loan / DBT (N/A) | 1,09 | 0,1886 | 0,1886 | ||||||

| Angel Oak Mortgage Trust, Series 2025-HB1, Class M3 / ABS-MBS (US034936AD60) | 1,09 | 0,1879 | 0,1879 | ||||||

| US35564KW700 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,08 | -2,00 | 0,1860 | -0,0291 | |||||

| Romark WM-R, Ltd., Series 2018-1A, Class E / ABS-CBDO (US77587CAC64) | 1,08 | -23,33 | 0,1858 | -0,0888 | |||||

| US86361KAD90 / Structured Asset Investment Loan Trust 2006-BNC3, Class A4 | 1,07 | 6,03 | 0,1851 | -0,0127 | |||||

| XS2211860106 / SYON 2020-2, Class B | 1,07 | 2,68 | 0,1850 | -0,0191 | |||||

| XS2478690261 / Polaris PLC, Series 2022-2, Class E | 1,07 | 7,76 | 0,1844 | -0,0094 | |||||

| East One PLC, Series 2024-1, Class E / ABS-MBS (XS2790098862) | 1,07 | 9,11 | 0,1839 | -0,0069 | |||||

| Triangle Re, Ltd., Series 2023-1, Class M1B / ABS-MBS (US89589AAB52) | 1,06 | -0,37 | 0,1834 | -0,0252 | |||||

| Kinbane 2024-Rpl 2 DAC, Series 2024-RPL2X, Class D / ABS-MBS (XS2929503816) | 1,05 | 8,48 | 0,1808 | -0,0081 | |||||

| Roc Mortgage Trust, Series 2024-RTL1, Class M1 / ABS-MBS (US77118UAC45) | 1,05 | 39,79 | 0,1804 | 0,0341 | |||||

| US126395AL68 / CSMC 2020-FACT | 1,04 | 117,75 | 0,1799 | 0,0863 | |||||

| TAGUS-Sociedade de Titularizacao de Creditos SA/Vasco Finance No. 2, Series 2024-2, Class F / ABS-O (PTTGCGOM0027) | 1,03 | 8,85 | 0,1782 | -0,0072 | |||||

| US00092CAE21 / ACHV ABS TRUST, Series 2023-4CP, Class E | 1,03 | 0,88 | 0,1782 | -0,0218 | |||||

| US74390NAJ19 / Prosper Marketplace Issuance Trust Series 2023-1, Series 2023-1A, Class E | 1,03 | 1,38 | 0,1778 | -0,0209 | |||||

| US43731BAB71 / Home RE, Ltd., Series 2023-1, Class M1B | 1,03 | -0,48 | 0,1772 | -0,0247 | |||||

| TAGUS-Sociedade de Titularizacao de Creditos SA/Vasco Finance No. 2, Series 2024-2, Class E / ABS-O (PTTGCFOM0028) | 1,02 | 8,03 | 0,1765 | -0,0086 | |||||

| Upstart Securitization Trust, Series 2025-1, Class C / ABS-O (US91684PAC05) | 1,02 | 0,1759 | 0,1759 | ||||||

| Bain Capital Credit CLO 2018-2, Series 2018-2A, Class F / ABS-CBDO (US05682WAE30) | 1,02 | 23,34 | 0,1758 | 0,0142 | |||||

| TVC Mortgage Trust, Series 2025-RRTL1, Class A2 / ABS-MBS (US900927AB08) | 1,02 | 0,1751 | 0,1751 | ||||||

| GoodLeap Home Improvement Solutions Trust 2024-1, Series 2024-1A, Class C / ABS-O (US381935AC91) | 1,01 | 0,1746 | 0,1746 | ||||||

| Merchants Fleet Funding LLC, Series 2024-1A, Class E / ABS-O (US588926AK19) | 1,01 | 0,50 | 0,1746 | -0,0222 | |||||

| Tricolor Auto Securitization Trust 2025-1, Series 2025-1A, Class E / ABS-O (US89617CAE12) | 1,00 | 0,1719 | 0,1719 | ||||||

| US74980YAA29 / RR 17 Ltd | 1,00 | 0,1715 | 0,1715 | ||||||

| Consumer Portfolio Services Auto Trust, Series 2025-A, Class E / ABS-O (US12633SAE81) | 0,99 | -2,27 | 0,1708 | -0,0274 | |||||

| Carvana Auto Receivables Trust, Series 2024-P4, Class R / ABS-O (US14076LAK98) | 0,99 | 0,82 | 0,1704 | -0,0213 | |||||

| Fylde Funding PLC, Series 2024-1, Class E / ABS-MBS (XS2881664556) | 0,98 | 6,63 | 0,1691 | -0,0106 | |||||

| Satus PLC, Series 2024-1, Class D / ABS-O (XS2801109906) | 0,97 | 6,11 | 0,1676 | -0,0114 | |||||

| US126395AG73 / CSMC 2020-FACT | 0,97 | -0,41 | 0,1676 | -0,0231 | |||||

| Magnetite Xlii, Ltd., Series 2024-42A, Class A1 / ABS-CBDO (US55955XAA46) | 0,96 | 0,1661 | 0,1661 | ||||||

| Pagaya AI Debt Selection Trust, Series 2024-7, Class D / ABS-O (US69548MAA36) | 0,96 | -7,42 | 0,1657 | -0,0371 | |||||

| US78457JAQ58 / SMRT 2022-MINI SOFR30A+330 01/15/2024 144A | 0,96 | 0,1647 | 0,1647 | ||||||

| Small Business Origination Loan Trust DAC, Series 2025-1, Class B / ABS-O (XS3045380824) | 0,95 | 0,1641 | 0,1641 | ||||||

| Octane Receivables Trust 2023-2, Series 2023-2A, Class E / ABS-O (US67571QAF72) | 0,94 | -0,74 | 0,1622 | -0,0229 | |||||

| SABADELL CONSUMO 2 FDT, Series 2022-2, Class E / ABS-O (ES0305622047) | 0,94 | -4,38 | 0,1618 | -0,0299 | |||||

| CIFC Funding 2014-III, Ltd., Series 2025-3A, Class FR / ABS-CBDO (US12549RAN35) | 0,94 | 0,1617 | 0,1617 | ||||||

| Santander Drive Auto Receivables Trust, Series 2024-S3, Class CERT / ABS-O (US80288CAE84) | 0,92 | -18,35 | 0,1587 | -0,0616 | |||||

| IT0005561300 / Golden Bar Securitisation SRL, Series 2023-2, Class D | 0,92 | 0,1580 | 0,1580 | ||||||

| Angel Oak Mortgage Trust, Series 2025-HB1, Class M1 / ABS-MBS (US034936AB05) | 0,92 | 0,1578 | 0,1578 | ||||||

| Pagaya AI Debt Grantor Trust 2024-6 and Pagaya AI Debt Trust, Series 2024-6, Class D / ABS-O (US69548LAA52) | 0,91 | -12,58 | 0,1570 | -0,0464 | |||||

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class E / ABS-MBS (XS2844410956) | 0,91 | 8,76 | 0,1563 | -0,0065 | |||||

| US33846BAN47 / FCAT 23-3 E 144A 9.74% 06-17-30/04-17-28 | 0,90 | -1,64 | 0,1554 | -0,0235 | |||||

| Prestige Auto Receivables Trust 2025-1, Series 2025-1A, Class E / ABS-O (US74113UAL61) | 0,90 | 0,1552 | 0,1552 | ||||||

| US36264YAE05 / GS MTG SECS CORP TR 2021-ROSS 1ML+160 05/15/2026 144A | 0,90 | 0,90 | 0,1549 | -0,0191 | |||||

| Upstart Pass-Through Trust, Series 2020-ST5, Class CERT / ABS-O (US91680WAB19) | 0,89 | -2,72 | 0,1542 | -0,0254 | |||||

| US75114HAB33 / RALI Trust, Class 1A2 | 0,89 | 4,70 | 0,1537 | -0,0127 | |||||

| US12632QAG82 / COMM 2014-CCRE18 Mortgage Trust | 0,88 | -2,96 | 0,1524 | -0,0256 | |||||

| XS2085724156 / MPT Operating Partnership LP / MPT Finance Corp | 0,88 | 0,1520 | 0,1520 | ||||||

| Mulcair Securities, Series 2025-4, Class C / ABS-MBS (XS3045473165) | 0,88 | 0,1518 | 0,1518 | ||||||

| Satus PLC, Series 2024-1, Class E / ABS-O (XS2801110235) | 0,88 | 5,28 | 0,1512 | -0,0115 | |||||

| Pagaya AI Debt Grantor Trust, Series 2024-5, Class D / ABS-O (US69546WAA36) | 0,87 | -17,31 | 0,1506 | -0,0558 | |||||

| ACM Auto Trust 2024-1, Series 2024-1A, Class B / ABS-O (US00161CAB46) | 0,87 | -0,68 | 0,1504 | -0,0213 | |||||

| Elmwood CLO X, Ltd., Series 2024-3A, Class FR / ABS-CBDO (US29002WAJ53) | 0,86 | 0,1482 | 0,1482 | ||||||

| US46591JAL08 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-BKWD | 0,85 | 0,59 | 0,1469 | -0,0186 | |||||

| GreenSky Home Improvement Issuer Trust 2025-1, Series 2025-1A, Class E / ABS-O (US39571NAH98) | 0,85 | 0,1467 | 0,1467 | ||||||

| US61767YAC49 / Morgan Stanley Capital I Inc | 0,85 | 3,28 | 0,1465 | -0,0143 | |||||

| US03072SX752 / AMSI 2006-R1 M4 | 0,84 | 6,31 | 0,1454 | -0,0095 | |||||

| US63873VAG86 / Natixis Commercial Mortgage Securities Trust, Series 2019-FAME, Class C | 0,84 | -21,53 | 0,1453 | -0,0644 | |||||

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class F / ABS-MBS (XS2763609497) | 0,84 | 9,86 | 0,1442 | -0,0045 | |||||

| US449289AA58 / ICG US Clo 2021-1 Ltd | 0,84 | -1,88 | 0,1440 | -0,0222 | |||||

| US61765TAT07 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class G | 0,83 | 6,79 | 0,1437 | -0,0087 | |||||

| US86358EXR25 / SAIL 2005-8 M2 | 0,83 | 0,36 | 0,1435 | -0,0185 | |||||

| Affirm Asset Securitization Trust, Series 2024-B, Class E / ABS-O (US00835AAE82) | 0,83 | 0,1432 | 0,1432 | ||||||

| Vecht Residential B.V., Series 2023-1, Class X2 / ABS-MBS (XS2607534521) | 0,82 | 9,91 | 0,1416 | -0,0043 | |||||

| Jeronimo Funding DAC, Series 2025-1, Class D / ABS-MBS (XS2956119106) | 0,82 | 9,18 | 0,1416 | -0,0053 | |||||

| ACHV / Achieve Life Sciences, Inc. | 0,81 | 1,38 | 0,1396 | -0,0164 | |||||

| Jeronimo Funding DAC, Series 2025-1, Class C / ABS-MBS (XS2956118801) | 0,81 | 7,19 | 0,1387 | -0,0080 | |||||

| Oportun Funding Trust, Series 2024-3, Class D / ABS-O (US68377NAD30) | 0,80 | -0,25 | 0,1386 | -0,0189 | |||||

| Island Finance Trust 2025-1, Series 2025-1A, Class C / ABS-O (US463920AC29) | 0,80 | 4,57 | 0,1382 | -0,0115 | |||||

| SC Germany SA Compartment Consumer, Series 2025-1, Class E / ABS-O (XS3035236184) | 0,80 | 0,1378 | 0,1378 | ||||||

| XS2338169068 / Domi BV, Series 2021-1, Class E | 0,80 | 8,71 | 0,1377 | -0,0060 | |||||

| US69121PAY97 / OWNIT 2005-4 M1 | 0,80 | 5,28 | 0,1376 | -0,0104 | |||||

| Eurosail 2006-4np PLC, Series 2006-4X, Class D1C / ABS-MBS (XS0274214310) | 0,80 | 6,41 | 0,1374 | -0,0089 | |||||

| C-BASS , Series 2007-CB4, Class A1B / ABS-MBS (US1248MEAB54) | 0,79 | 4,89 | 0,1367 | -0,0111 | |||||

| US07401NAQ25 / Bear Stearns Mortgage Funding Trust 2006-AR5, Class 2A2 | 0,79 | 2,59 | 0,1366 | -0,0141 | |||||

| Asset-Backed European Securitisation Transaction Twenty-Three Sarl, Series 2024-23, Class M / ABS-O (XS2913205204) | 0,79 | 8,67 | 0,1362 | -0,0059 | |||||

| US61744CYR14 / MSHEL 2006-2 M2 | 0,79 | 5,91 | 0,1361 | -0,0093 | |||||

| FCT Ponant 1, Series 2025-1, Class E / ABS-O (FR001400UY26) | 0,79 | 0,1354 | 0,1354 | ||||||

| Pagaya AI Debt Trust, Series 2024-2, Class D / ABS-O (US694961AD51) | 0,79 | -25,87 | 0,1354 | -0,0715 | |||||

| Upstart Pass-Through Trust, Series 2021-ST1, Class CERT / ABS-O (US91681MAB28) | 0,78 | 0,1353 | 0,1353 | ||||||

| Youni Italy Srl, Series 2025-1, Class X / ABS-O (IT0005641128) | 0,78 | 0,1352 | 0,1352 | ||||||

| FCT Ponant 1, Series 2025-1, Class F / ABS-O (FR001400UY34) | 0,78 | 0,1349 | 0,1349 | ||||||

| Kinbane 2025-RPL1 DAC, Series 2025-RPL1X, Class F / ABS-MBS (XS3009459457) | 0,78 | 0,1346 | 0,1346 | ||||||

| US91534HAB24 / Upstart Pass-Through Trust, Series 2021-ST4, Class CERT | 0,78 | 38,86 | 0,1343 | -0,3833 | |||||

| Conn's Receivables Funding LLC, Series 2024-A, Class C / ABS-O (US20824DAC74) | 0,78 | -2,75 | 0,1340 | -0,0221 | |||||

| Octane Receivables Trust 2024-2, Series 2024-2A, Class E / ABS-O (US67578YAF34) | 0,78 | 0,1339 | 0,1339 | ||||||

| Polaris PLC, Series 2023-2, Class E / ABS-MBS (XS2673976275) | 0,77 | 7,06 | 0,1333 | -0,0077 | |||||

| GCAT , Series 2019-RPL1, Class B3 / ABS-MBS (US36167CAG15) | 0,77 | 0,1321 | 0,1321 | ||||||

| LHOME Mortgage Trust, Series 2025-RTL1, Class M1 / ABS-MBS (US50205UAC53) | 0,77 | 0,00 | 0,1319 | -0,0175 | |||||

| Island Finance Trust 2025-1, Series 2025-1A, Class B / ABS-O (US463920AB46) | 0,77 | 0,53 | 0,1318 | -0,0168 | |||||

| MFA , Series 2024-RTL3, Class A2 / ABS-MBS (US59319PAB22) | 0,76 | 17,93 | 0,1317 | -0,0240 | |||||

| VNTV 2025-RTL1 A2 / ABS-MBS (US928884AB18) | 0,76 | 0,1315 | 0,1315 | ||||||

| Newday Funding Master Issuer PLC - Series 2025-1, Series 2025-1X, Class E / ABS-O (XS3031614145) | 0,76 | 0,1314 | 0,1314 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M1 / ABS-MBS (US922955AD13) | 0,76 | 0,1313 | 0,1313 | ||||||

| Bear Stearns Mortgage Funding Trust, Series 2007-AR4, Class 2A2A / ABS-MBS (US07401YAR62) | 0,76 | 2,01 | 0,1312 | -0,0147 | |||||

| US40430FAA03 / HSI ASSET SECURITIZATION CORPO HASC 2007 HE1 1A1 | 0,76 | 0,53 | 0,1310 | -0,0167 | |||||

| Dominion Mortgage Trust, Series 2025-RTL1, Class A2 / ABS-MBS (US25746DAB38) | 0,76 | 0,1310 | 0,1310 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2024-6, Class M3 / ABS-MBS (US92261BAE65) | 0,76 | 1,88 | 0,1309 | -0,0147 | |||||

| TVC Mortgage Trust, Series 2025-RRTL1, Class M1 / ABS-MBS (US900927AC80) | 0,76 | 0,1308 | 0,1308 | ||||||

| Angel Oak Mortgage Trust, Series 2025-HB1, Class M2 / ABS-MBS (US034936AC87) | 0,76 | 0,1308 | 0,1308 | ||||||

| Dowson PLC, Series 2024-1, Class E / ABS-O (XS2919892252) | 0,76 | 7,37 | 0,1306 | -0,0074 | |||||

| ACM Auto Trust 2025-1, Series 2025-1A, Class B / ABS-O (US00161EAC84) | 0,76 | 0,00 | 0,1306 | -0,0172 | |||||

| Zip Master Trust, Series 2023-1, Class E / ABS-O (AU3FN0078499) | 0,76 | 0,93 | 0,1304 | -0,0158 | |||||

| US93934JAC80 / WASHINGTON MUTUAL ASSET BACKED WMABS 2006 HE2 A3 | 0,76 | 0,00 | 0,1304 | -0,0174 | |||||

| LHOME Mortgage Trust, Series 2025-RTL2, Class M1 / ABS-MBS (US50206RAC16) | 0,76 | 0,1303 | 0,1303 | ||||||

| Arini US Clo I, Ltd., Series 2025-1A, Class C / ABS-CBDO (US04039AAE47) | 0,76 | 0,1302 | 0,1302 | ||||||

| NOW Trust, Series 2025-1, Class E / ABS-O (AU3FN0095964) | 0,75 | 0,1301 | 0,1301 | ||||||

| US91683LAB27 / Upstart Pass-Through Trust Series 2021-ST8 | 0,75 | -7,37 | 0,1300 | -0,5658 | |||||

| Conn's Receivables Funding LLC, Series 2024-A, Class B / ABS-O (US20824DAB91) | 0,75 | -18,17 | 0,1297 | -0,0499 | |||||

| Whitebox CLO IV, Ltd., Series 2025-4A, Class A3R / ABS-CBDO (US96467KAY55) | 0,75 | 0,1296 | 0,1296 | ||||||

| Mulcair Securities, Series 2025-4, Class D / ABS-MBS (XS3045473678) | 0,75 | 0,1296 | 0,1296 | ||||||

| Reach ABS Trust 2024-2, Series 2024-2A, Class D / ABS-O (US75525HAD26) | 0,75 | 0,1296 | 0,1296 | ||||||

| Chenango Park CLO, Ltd., Series 2025-1A, Class CR / ABS-CBDO (US16409TAU34) | 0,75 | 0,1295 | 0,1295 | ||||||

| Oportun Funding Trust, Series 2025-1, Class D / ABS-O (US68377PAD87) | 0,75 | 0,1295 | 0,1295 | ||||||

| US20754EAJ47 / Fannie Mae Connecticut Avenue Securities | 0,75 | 0,1293 | 0,1293 | ||||||

| Whitebox CLO IV, Ltd., Series 2025-4A, Class D2R / ABS-CBDO (US96467KAW99) | 0,75 | 0,1292 | 0,1292 | ||||||

| Sound Point Clo 2025-2, Ltd., Series 2025-2A, Class D1 / ABS-CBDO (US83617PAJ49) | 0,75 | 0,1292 | 0,1292 | ||||||

| Aurorus 2023 BV, Series 2023-1, Class E / ABS-O (XS2698005696) | 0,75 | 0,1292 | 0,1292 | ||||||

| Flatiron CLO 19, Ltd., Series 2025-1A, Class DR2 / ABS-CBDO (US33883JBC45) | 0,75 | 0,1288 | 0,1288 | ||||||

| ES0305520043 / FTA Santander Consumo 4 | 0,74 | -8,15 | 0,1283 | -0,0301 | |||||

| Carvana Auto Receivables Trust, Series 2025-P1, Class R / ABS-O (US14689MAK62) | 0,74 | 0,1283 | 0,1283 | ||||||

| Vibrant CLO IX-R, Ltd., Series 2025-9RA, Class D2 / ABS-CBDO (US92557BAN91) | 0,74 | 0,1282 | 0,1282 | ||||||

| Flatiron CLO 19, Ltd., Series 2025-1A, Class CR2 / ABS-CBDO (US33883JBA88) | 0,74 | 0,1280 | 0,1280 | ||||||

| Tricolor Auto Securitization Trust 2024-2, Series 2024-2A, Class F / ABS-O (US89616PAF09) | 0,74 | 2,35 | 0,1278 | -0,0135 | |||||

| Towd Point Mortgage Funding 2024 - Granite 6 PLC, Series 2024-GR6X, Class F / ABS-MBS (XS2799790527) | 0,74 | 6,93 | 0,1278 | -0,0076 | |||||

| Allegro Clo XIX, Ltd., Series 2025-1A, Class D2 / ABS-CBDO (US01749XAJ00) | 0,74 | 0,1278 | 0,1278 | ||||||

| XS2425829939 / Polaris plc, Series 2022-1, Class E | 0,74 | 7,29 | 0,1269 | -0,0072 | |||||

| US20754NAR61 / FANNIE MAE CAS CAS 2022 R06 1B2 144A | 0,73 | -3,31 | 0,1259 | -0,0216 | |||||

| Allegro Clo XIX, Ltd., Series 2025-1A, Class C / ABS-CBDO (US01749XAE13) | 0,73 | 0,1250 | 0,1250 | ||||||

| US36258BAW81 / GS MORTGAGE SECURITIES CORP TRUST 2020-DUNE SER 2020-DUNE CL G V/R REGD 144A P/P 5.70000000 | 0,72 | -2,30 | 0,1246 | -0,0200 | |||||

| Tricolor Auto Securitization Trust 2024-2, Series 2024-2A, Class E / ABS-O (US89616PAE34) | 0,72 | 0,56 | 0,1246 | -0,0157 | |||||

| Plenti PL-Green ABS Trust, Series 2024-2, Class F / ABS-O (AU3FN0092482) | 0,72 | 2,70 | 0,1244 | -0,0130 | |||||

| XS0311695778 / Eurohome UK Mortgages Plc, Series 2007-2, Class B1 | 0,71 | -58,31 | 0,1224 | -0,2102 | |||||

| Eaton Vance CLO 2014-1R, Ltd., Series 2018-1RA, Class E / ABS-CBDO (US27830UAA07) | 0,71 | -6,61 | 0,1219 | -0,0259 | |||||

| US20753ACF93 / Connecticut Avenue Securities Trust, Series 2023-R03, Class 2B1 | 0,70 | -1,96 | 0,1205 | -0,0188 | |||||

| US91681WAB00 / Upstart Pass-Through Trust, Series 2021-ST10, Class CERT | 0,70 | 527,03 | 0,1201 | 0,0982 | |||||

| US12595KAG67 / CSMC Trust 2017-PFHP | 0,68 | 0,1178 | 0,1178 | ||||||

| Mortimer 2024-Mix PLC, Series 2024-MIX, Class X / ABS-MBS (XS2920414971) | 0,68 | -5,83 | 0,1172 | -0,0238 | |||||

| US67110VAC19 / OHALF 2016-1A SUB | 0,68 | 0,1169 | 0,1169 | ||||||

| US91680VAB36 / Upstart Pass-Through Trust Series 2021-ST6 | 0,67 | 44,16 | 0,1148 | -0,2802 | |||||

| ES0305743041 / FTA Santander Consumer Spain Auto, Series 2023-1, Class E | 0,67 | 1,68 | 0,1148 | -0,0131 | |||||

| OHA Credit Funding 4, Ltd., Series 2019-4A, Class SUB / ABS-CBDO (US67098EAE14) | 0,66 | -11,47 | 0,1145 | -0,0320 | |||||

| US46626LHD55 / JP Morgan Mortgage Acquisition Corp., Class M3 | 0,66 | 7,72 | 0,1132 | -0,0059 | |||||

| US46640NAR98 / JPMorgan Chase Commercial Mortgage Securities Trust | 0,66 | -9,03 | 0,1130 | -0,0276 | |||||

| ES0305694046 / FT Rmbs Miravet, Series 2023-1, Class E | 0,65 | 10,92 | 0,1121 | -0,0024 | |||||

| US25151XAD30 / Deutsche Alt-A Securities Mortgage Loan Trust Series 2007-OA4 | 0,65 | 4,17 | 0,1121 | -0,0098 | |||||

| US91679XAB29 / Upstart Pass-Through Trust Series | 0,65 | -7,41 | 0,1121 | -0,5224 | |||||

| ES0305694053 / FT Rmbs Miravet, Series 2023-1, Class F | 0,64 | 11,44 | 0,1109 | -0,0019 | |||||

| US03072SE844 / AMSI 2005-R5 M7 | 0,63 | 5,84 | 0,1094 | -0,0076 | |||||

| US12667AAE64 / Countrywide Asset-Backed Certificates, Series 2006-12, Class M1 | 0,63 | 9,31 | 0,1093 | -0,0041 | |||||

| XS0311815855 / Uropa Securities PLC, Series 2007-1, Class B1A | 0,63 | 7,29 | 0,1092 | -0,0062 | |||||

| Eurosail 2006-3nc PLC, Series 2006-3X, Class D1A / ABS-MBS (XS0271946724) | 0,63 | 8,40 | 0,1090 | -0,0049 | |||||

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class E / ABS-MBS (XS2763609141) | 0,63 | 10,53 | 0,1086 | -0,0027 | |||||

| Kinbane 2024-RPL 1 DAC, Series 2024-RPL1X, Class D / ABS-MBS (XS2763608929) | 0,63 | 9,06 | 0,1080 | -0,0042 | |||||

| Dilosk Rmbs NO 9 Dac, Series 2024-9, Class X2 / ABS-MBS (XS2813213316) | 0,62 | 16,20 | 0,1063 | 0,0025 | |||||

| US22551EAE68 / Credito Real USA Auto Receivables Trust 2021-1 | 0,61 | -29,02 | 0,1060 | -0,0630 | |||||

| US94989VBF58 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class G | 0,61 | 4,43 | 0,1058 | -0,0090 | |||||

| US89600HAG48 / TMIR_21-3 | 0,61 | -0,33 | 0,1053 | -0,0145 | |||||

| Bbva Consumer Auto FT, Series 2024-1, Class Z / ABS-O (ES0305796056) | 0,61 | 55,36 | 0,1051 | 0,0285 | |||||

| Bbva Consumer Auto FT, Series 2024-1, Class E / ABS-O (ES0305796049) | 0,61 | 28,21 | 0,1050 | 0,0121 | |||||

| US70069FLL93 / PPSI 2005-WCW2 M5 | 0,61 | 8,59 | 0,1046 | -0,0046 | |||||

| Stratton Mortgage Funding 2024-1 PLC, Series 2024-1A, Class F / ABS-MBS (XS2728574588) | 0,61 | 6,32 | 0,1046 | -0,0067 | |||||

| US144527AE87 / CARR 2007-FRE1 M1 | 0,61 | 8,04 | 0,1043 | -0,0051 | |||||

| US63942LAC63 / Navient Private Education Refi Loan Trust 2021-B, Series 2021-BA, Class R | 0,60 | -10,30 | 0,1036 | -0,0274 | |||||

| US456606KJ09 / INABS 2006-A M1 | 0,59 | 9,59 | 0,1025 | -0,0035 | |||||

| XS2500384701 / Parkmore Point RMBS 2022-1 PLC, Series 2022-1X, Class D | 0,59 | 6,92 | 0,1013 | -0,0060 | |||||

| US43709BAG41 / INABS 2006-C M1 | 0,59 | 6,75 | 0,1008 | -0,0063 | |||||

| Recv Irs 4.0074 06/20/29 / DIR (N/A) | 0,58 | 0,1008 | 0,1008 | ||||||

| US91683NAB82 / Upstart Pass-Through Trust Series 2022-ST1 | 0,58 | 197,45 | 0,1005 | 0,0667 | |||||

| Towd Point Mortgage Trust, Series 2017-1, Class B4 / ABS-MBS (US89173FAH38) | 0,58 | 6,40 | 0,1004 | -0,0066 | |||||

| SCF Rahoituspalvelut XIII DAC, Series 2024-13, Class E / ABS-O (XS2816095215) | 0,58 | 10,34 | 0,0993 | -0,0026 | |||||

| US05493LAL09 / BANC OF AMERICA MERRILL LYNCH BAMLL 2021 JACX D 144A | 0,58 | 1,41 | 0,0993 | -0,0116 | |||||

| Landmark Mortgage Securities No 3 PLC, Series 2007-3, Class D / ABS-MBS (XS1110750699) | 0,57 | 6,49 | 0,0991 | -0,0063 | |||||

| XS2673976432 / Polaris PLC, Series 2023-2, Class F | 0,57 | 8,92 | 0,0990 | -0,0040 | |||||

| XS2601814754 / Atlas Funding PLC, Series 2023-1, Class F | 0,57 | 7,92 | 0,0987 | -0,0049 | |||||

| Angel Oak Mortgage Trust, Series 2025-HB1, Class A1 / ABS-MBS (US034936AA22) | 0,57 | 0,0985 | 0,0985 | ||||||

| Noria DE 2024, Series 2024-DE1, Class F / ABS-O (FR001400R8I0) | 0,57 | 9,60 | 0,0985 | -0,0034 | |||||

| Bletchley Park Funding PLC, Series 2024-1, Class E / ABS-MBS (XS2850625786) | 0,57 | 6,55 | 0,0982 | -0,0061 | |||||

| Castell PLC, Series 2023-2, Class G / ABS-MBS (XS2706210585) | 0,57 | 7,58 | 0,0980 | -0,0052 | |||||

| Pony SA, Series 2024-1, Class E / ABS-O (XS2845211536) | 0,57 | 7,81 | 0,0977 | -0,0049 | |||||

| GAMMA Sociedade de Titularizacao de Creditos, Series 2024-2, Class D / ABS-O (PTGAMPOM0017) | 0,57 | 9,06 | 0,0977 | -0,0038 | |||||

| US61691KAN19 / MSC_17-ASHF | 0,56 | -0,88 | 0,0972 | -0,0140 | |||||

| Fortuna Consumer Loan Abs DAC, Series 2024-2, Class G / ABS-O (XS2887891005) | 0,56 | 8,29 | 0,0970 | -0,0045 | |||||

| Latitude Australia Credit Card Master Trust, Series 2024-2, Class E / ABS-O (AU3FN0091484) | 0,56 | 2,19 | 0,0965 | -0,0105 | |||||

| Magnetite XXVI, Ltd., Series 2025-26A, Class AR2 / ABS-CBDO (US55954YAW57) | 0,56 | 0,0962 | 0,0962 | ||||||

| Markit CDX NA High Yield Index, Series 42 / DCR (N/A) | 0,56 | 0,0961 | 0,0961 | ||||||

| US17321RAM88 / Citigroup Commercial Mortgage Trust 2013-GC17 | 0,56 | 0,91 | 0,0957 | -0,0118 | |||||

| US04541GXD95 / ABSHE 2006-HE3 M1 | 0,56 | 6,94 | 0,0957 | -0,0058 | |||||

| US46591JAA43 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-BKWD | 0,55 | -1,07 | 0,0955 | -0,0140 | |||||

| Dilosk RMBS No 8 Sts DAC, Series 2024-STS, Class F / ABS-MBS (XS2736584918) | 0,55 | 8,24 | 0,0952 | -0,0045 | |||||

| XS2610185196 / Polaris PLC, Series 2023-1, Class F | 0,55 | 6,59 | 0,0948 | -0,0060 | |||||

| Elstree Funding No 5 PLC, Series 2024-5, Class F / ABS-MBS (XS2913080581) | 0,55 | 9,58 | 0,0947 | -0,0032 | |||||

| US86362VAF94 / SASC 2006-BC6 M1 | 0,55 | 8,78 | 0,0940 | -0,0039 | |||||

| Domi BV, Series 2024-1, Class E / ABS-MBS (XS2822578238) | 0,55 | 11,45 | 0,0939 | -0,0017 | |||||

| US76090YAA47 / Research-Driven Pagaya Motor Asset Trust 2023-3, Series 2023-3A, Class C | 0,54 | 0,18 | 0,0939 | -0,0123 | |||||

| KKR CLO 15, Ltd., Series 2024-15, Class ER2 / ABS-CBDO (US48251LAJ70) | 0,54 | -70,14 | 0,0936 | -0,2609 | |||||

| Polaris PLC, Series 2024-1, Class F / ABS-MBS (XS2765489302) | 0,54 | 8,63 | 0,0934 | -0,0039 | |||||

| US35565HBE45 / Freddie Mac Stacr Remic Trust 2020-DNA1 | 0,54 | -2,35 | 0,0932 | -0,0149 | |||||

| Research-Driven Pagaya Motor Asset Trust 2023-4, Series 2023-4A, Class C / ABS-O (US76088XAA00) | 0,54 | 0,19 | 0,0929 | -0,0120 | |||||

| Molossus Btl PLC, Series 2024-1, Class F / ABS-MBS (XS2793367124) | 0,54 | 8,47 | 0,0928 | -0,0040 | |||||

| US90945CAJ18 / United Auto Credit Securitization Trust, Series 2023-1, Class E | 0,54 | -0,74 | 0,0927 | -0,0133 | |||||

| Eurohome UK Mortgages 2007 -1 PLC, Series 2007-1, Class B2 / ABS-MBS (XS0290420982) | 0,54 | 6,53 | 0,0927 | -0,0060 | |||||

| Finance Ireland RMBS NO 7 DAC, Series 2024-7, Class E / ABS-MBS (XS2837216550) | 0,53 | 10,10 | 0,0920 | -0,0027 | |||||

| Rochester Financing No 3 PLC, Series 2021-3, Class E / ABS-MBS (XS2348604377) | 0,53 | 9,22 | 0,0920 | -0,0035 | |||||

| Compartment BL Consumer Credit 2024, Series 2024-1, Class F / ABS-O (XS2758922624) | 0,53 | 8,55 | 0,0919 | -0,0042 | |||||

| US05554BAN47 / BFLD Trust, Series 2021-FPM, Class E | 0,53 | 0,19 | 0,0919 | -0,0122 | |||||

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class C / ABS-MBS (XS2844410790) | 0,53 | 9,00 | 0,0919 | -0,0037 | |||||

| Merrion Square Residential 2024-1 DAC, Series 2024-1X, Class D / ABS-MBS (XS2844410873) | 0,53 | 8,37 | 0,0916 | -0,0041 | |||||

| XS2592627637 / SMI Equity Release 2018-1 DAC, Series 2023-1, Class BRR | 0,53 | 8,20 | 0,0911 | -0,0042 | |||||

| US31659TEK79 / Fieldstone Mortgage Investment Trust, Series 2005-3, Class M2 | 0,53 | 6,24 | 0,0911 | -0,0061 | |||||

| US83611MMM72 / SVHE 2006-OPT2 M1 | 0,53 | 1,15 | 0,0911 | -0,0109 | |||||

| Rochester Financing No 3 PLC, Series 2021-3, Class F / ABS-MBS (XS2348604534) | 0,53 | 7,76 | 0,0910 | -0,0047 | |||||

| US00441YAF97 / ACE Securities Corp. Home Equity Loan Trust, Series 2006-OP2, Class M1 | 0,53 | 11,65 | 0,0909 | -0,0014 | |||||

| US32027NZN47 / First Franklin Mortgage Loan Trust 2006-FFH1 | 0,53 | 6,48 | 0,0908 | -0,0057 | |||||

| Stratton Mortgage Funding 2024-2 PLC, Series 2024-2X, Class E / ABS-MBS (XS2777471629) | 0,53 | 6,69 | 0,0907 | -0,0057 | |||||

| Pepper Iberia Unsecured 2022 DAC, Series 2022-1, Class E / ABS-O (XS2470181319) | 0,53 | 8,68 | 0,0907 | -0,0039 | |||||

| Stratton Mortgage Funding PLC, Series 2024-3, Class E / ABS-MBS (XS2819830915) | 0,53 | 7,36 | 0,0905 | -0,0050 | |||||

| US74390NAG79 / Prosper Marketplace Issuance Trust Series 2023-1A, Class D | 0,52 | 1,35 | 0,0903 | -0,0107 | |||||

| SAFCO Auto Receivables Trust 2024-1, Series 2024-1A, Class E / ABS-O (US78637EAE68) | 0,52 | 0,00 | 0,0903 | -0,0121 | |||||

| XS0311816150 / UROPA SECURITIES PLC UROPA 2007 1 B1B REGS | 0,52 | 8,96 | 0,0902 | -0,0036 | |||||

| XS0311816408 / Uropa Securities PLC, Series 2007-1, Class B2A | 0,52 | 6,11 | 0,0899 | -0,0060 | |||||

| Harben Finance, Series 2022-1RA, Class G / ABS-MBS (XS2433828311) | 0,52 | 6,98 | 0,0899 | -0,0053 | |||||

| US126673ZH84 / Countrywide Asset-Backed Certificates, Series 05-2, Class M6 | 0,52 | 7,66 | 0,0897 | -0,0048 | |||||

| Zip Master Trust, Series 2023-2, Class E / ABS-O (AU3FN0082152) | 0,52 | 0,58 | 0,0892 | -0,0112 | |||||

| US05493HAN52 / BBCMS Trust | 0,52 | 0,98 | 0,0891 | -0,0109 | |||||

| Stratton Mortgage Funding PLC, Series 2024-3, Class F / ABS-MBS (XS2819831053) | 0,51 | 5,76 | 0,0886 | -0,0065 | |||||

| Quarzo Srl, Series 2024-1, Class D / ABS-O (IT0005599342) | 0,51 | -2,10 | 0,0886 | -0,0141 | |||||

| Plenti PL-Green ABS Trust, Series 2024-1, Class E / ABS-O (AU3FN0083937) | 0,51 | -10,47 | 0,0885 | -0,0234 | |||||

| US36264YAA82 / GS Mortgage Securities Corp II | 0,51 | -0,78 | 0,0882 | -0,0124 | |||||

| ACM Auto Trust 2024-2, Series 2024-2A, Class B / ABS-O (US00461WAC55) | 0,51 | -0,97 | 0,0881 | -0,0127 | |||||

| Purchasing Power Funding LLC, Series 2024-A, Class E / ABS-O (US745935AE61) | 0,51 | -0,39 | 0,0876 | -0,0121 | |||||

| US126673UT77 / CWABS Asset-Backed Certificates Trust, Series 2004-15, Class MV7 | 0,51 | 1,60 | 0,0875 | -0,0100 | |||||

| Homeward Opportunities Fund Trust, Series 2024-RRTL2, Class M1 / ABS-MBS (US43789GAE17) | 0,51 | -0,39 | 0,0874 | -0,0120 | |||||

| Radnor Re, Ltd., Series 2024-1, Class M1C / ABS-MBS (US75049AAE29) | 0,51 | -0,39 | 0,0872 | -0,0118 | |||||

| Compartment BL Consumer Credit 2024, Series 2024-1, Class E / ABS-O (XS2758922384) | 0,51 | 8,60 | 0,0872 | -0,0038 | |||||

| LHOME Mortgage Trust, Series 2024-RTL4, Class M1 / ABS-MBS (US50205PAC68) | 0,50 | -0,40 | 0,0870 | -0,0120 | |||||

| Equify ABS 2024-1 LLC, Series 2024-1A, Class D / ABS-O (US29445TAD00) | 0,50 | 1,61 | 0,0870 | -0,0098 | |||||

| Polaris PLC, Series 2021-1, Class F / ABS-MBS (XS2363113841) | 0,50 | 7,48 | 0,0867 | -0,0048 | |||||

| XS0287767304 / Newgate Funding PLC, Series 2007-1X, Class DB | 0,50 | 7,26 | 0,0867 | -0,0048 | |||||

| LHOME Mortgage Trust, Series 2024-RTL5, Class M1 / ABS-MBS (US50205WAC10) | 0,50 | 0,40 | 0,0866 | -0,0111 | |||||

| GreenSky Home Improvement Issuer Trust, Series 2024-2, Class E / ABS-O (US39571XAH70) | 0,50 | 0,0864 | 0,0864 | ||||||

| US91682NAD57 / Upstart Securitization Trust 2021-4 | 0,50 | -0,79 | 0,0862 | -0,0122 | |||||

| US05554BAL80 / BFLD Trust, Series 2021-FPM, Class D | 0,50 | 0,20 | 0,0862 | -0,0114 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-2, Class M4 / ABS-MBS (US92259PAE97) | 0,50 | 0,40 | 0,0861 | -0,0110 | |||||

| US05591VAJ44 / BPR Trust 2021-WILL | 0,50 | 0,20 | 0,0860 | -0,0113 | |||||

| US05591VAE56 / BPR Trust 2021-WILL | 0,50 | 0,20 | 0,0860 | -0,0113 | |||||

| US89600GAE17 / TMIR_21-2 | 0,50 | -0,80 | 0,0860 | -0,0123 | |||||

| Research-Driven Pagaya Motor Asset Trust 2025-1, Series 2025-1A, Class E / ABS-O (US76100AAB26) | 0,49 | 0,0852 | 0,0852 | ||||||

| Newgate Funding PLC, Series 2007-2X, Class E / ABS-MBS (XS0304280489) | 0,49 | 5,34 | 0,0851 | -0,0064 | |||||

| Brignole Co., Series 2024-2024, Class D / ABS-O (IT0005598385) | 0,49 | 4.830,00 | 0,0850 | 0,0830 | |||||

| Zip Master Trust, Series 2024-1, Class E / ABS-O (AU3FN0085890) | 0,49 | 2,51 | 0,0846 | -0,0090 | |||||

| Zip Master Trust, Series 2024-1, Class F / ABS-O (AU3FN0085908) | 0,49 | 2,52 | 0,0844 | -0,0089 | |||||

| US53946XAD57 / Lobel Automobile Receivables Trust, Series 2023-1, Class D | 0,49 | 0,21 | 0,0838 | -0,0111 | |||||

| XS2698017600 / Aurorus 2023 BV, Series 2023-1, Class G | 0,48 | -1,03 | 0,0830 | -0,0120 | |||||

| Auto ABS Spanish Loans FT, Series 2024-1, Class E / ABS-O (ES0305837041) | 0,48 | 3,23 | 0,0829 | -0,0081 | |||||

| Oaktree CLO 2021-2, Ltd., Series 2021-2A, Class F / ABS-CBDO (US67389CAE30) | 0,48 | -5,70 | 0,0829 | -0,0166 | |||||

| US91683VAC81 / UPSTART SECURITIZATION TRUST 2023-2 UPST 2023-2 C | 0,48 | -0,83 | 0,0827 | -0,0117 | |||||

| Brignole Co., Series 2024-2024, Class F / ABS-O (IT0005598401) | 0,48 | -1,65 | 0,0825 | -0,0125 | |||||

| US36264YAG52 / GS Mortgage Securities Corp II | 0,48 | 7,43 | 0,0823 | -0,0045 | |||||

| Zip Master Trust, Series 2024-2, Class E / ABS-O (AU3FN0090080) | 0,48 | 1,06 | 0,0821 | -0,0099 | |||||

| XS0328025324 / Eurosail-UK 2007-5np PLC, Series 2007-5X, Class B1C | 0,47 | 6,53 | 0,0816 | -0,0051 | |||||

| Business Mortgage Finance 7 PLC, Series 2007-7X, Class M1 / ABS-O (XS0330220855) | 0,47 | 1,73 | 0,0813 | -0,0092 | |||||

| XS2698005852 / Aurorus 2023 BV, Series 2023-1, Class F | 0,47 | -1,68 | 0,0809 | -0,0124 | |||||

| Domi BV, Series 2024-1, Class X / ABS-MBS (XS2822578584) | 0,47 | -6,41 | 0,0806 | -0,0168 | |||||

| E-Carat DE, Series 2024-1, Class F / ABS-O (XS2833388197) | 0,46 | 8,57 | 0,0787 | -0,0034 | |||||

| E-MAC Program BV, Series 2007-NL3X, Class D / ABS-MBS (XS0307683291) | 0,46 | 3,40 | 0,0786 | -0,0076 | |||||

| Bbva Consumer Auto Fondo De Titulizacion, Series 2022-1, Class E / ABS-O (ES0305654040) | 0,46 | -1,94 | 0,0785 | -0,0123 | |||||

| IT0005560302 / Red & Black Auto Italy Srl, Series 2023-2, Class E | 0,45 | -2,78 | 0,0784 | -0,0129 | |||||

| FTA Santander Consumo 6, Series 2024-6, Class F / ABS-O (ES0305799050) | 0,45 | 8,92 | 0,0780 | -0,0032 | |||||

| US91680YAP60 / Upstart Structured Pass-Through Trust, Series 2022-1A, Class CERT | 0,44 | 12,69 | 0,0766 | -0,0005 | |||||

| XS0277453691 / RMAC Securities PLC, Series 2006-NS4X, Class B1C | 0,44 | 3,79 | 0,0756 | -0,0068 | |||||

| NYMTM / New York Mortgage Trust, Inc. - Preferred Stock | 0,02 | 0,00 | 0,44 | -2,01 | 0,0755 | -0,0119 | |||

| Bbva Consumer Auto FT, Series 2024-1, Class D / ABS-O (ES0305796031) | 0,43 | -6,67 | 0,0749 | -0,0160 | |||||

| Dilosk RMBS No 8 Sts DAC, Series 2024-STS, Class X / ABS-MBS (XS2736585055) | 0,43 | -5,25 | 0,0747 | -0,0146 | |||||

| US83405N1063 / SoFi Professional Loan Program 2021-B Trust | 0,43 | -0,23 | 0,0745 | -0,0102 | |||||

| Exmoor Funding PLC, Series 2024-1, Class X / ABS-MBS (XS2811066278) | 0,43 | -10,44 | 0,0741 | -0,0196 | |||||

| ES0305733059 / Autonoria Spain 2023 FT, Series 2023-SP, Class F | 0,42 | -1,40 | 0,0730 | -0,0110 | |||||

| US94989VBD01 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS3, Class F | 0,41 | 3,26 | 0,0711 | -0,0069 | |||||

| FR00140048Q6 / FCT Noria 2021, Series 2021-1, Class G | 0,41 | -4,43 | 0,0708 | -0,0130 | |||||

| Molossus Btl PLC, Series 2024-1, Class X / ABS-MBS (XS2793367637) | 0,41 | -3,33 | 0,0701 | -0,0122 | |||||

| Tricolor Auto Securitization Trust 2024-1, Series 2024-1A, Class E / ABS-O (US89616LAE20) | 0,40 | 0,25 | 0,0694 | -0,0090 | |||||

| US43730GAC50 / Home RE 2022-1 Ltd | 0,40 | -1,72 | 0,0690 | -0,0105 | |||||

| XS0250834073 / Lansdowne Mortgage Securities No 1 PLC, Class M2 | 0,40 | 9,02 | 0,0688 | -0,0027 | |||||

| US45660L4A42 / Residential Asset Securitization Trust, Series 2005-A15, Class 2A10 | 0,40 | -8,72 | 0,0686 | -0,0166 | |||||

| COMM, Series 2019-GC44 Mortgage Trust, Class 180A / ABS-MBS (US12655TAW99) | 0,40 | 1,79 | 0,0685 | -0,0077 | |||||

| Brignole Co., Series 2024-2024, Class E / ABS-O (IT0005598393) | 0,40 | -1,74 | 0,0682 | -0,0106 | |||||

| Plenti PL-Green ABS Trust, Series 2024-1, Class F / ABS-O (AU3FN0083945) | 0,39 | -10,34 | 0,0673 | -0,0178 | |||||

| AU3FN0002671 / AIMS , Series 2007-1, Class B | 0,39 | 1,31 | 0,0666 | -0,0079 | |||||

| US75115CAE75 / RALI Trust, Class 1A5 | 0,38 | -5,28 | 0,0650 | -0,0128 | |||||

| Hermitage 2024 PLC, Series 2024-1, Class E / ABS-MBS (XS2847617078) | 0,37 | -4,35 | 0,0645 | -0,0119 | |||||

| Small Business Origination Loan Trust DAC, Series 2024-1, Class D / ABS-O (XS2821806770) | 0,37 | -4,20 | 0,0631 | -0,0115 | |||||

| ES0305676043 / FTA Santander Consumer Spain Auto, Series 2022-1, Class E | 0,36 | -2,69 | 0,0625 | -0,0103 | |||||

| ES0305646038 / Auto Abs Spanish Loans Fondo Titulizacion, Series 2022-1, Class D | 0,36 | -9,30 | 0,0623 | -0,0155 | |||||

| AU3FN0076329 / Metro Finance , Series 2023-1, Class E | 0,36 | -7,99 | 0,0616 | -0,0143 | |||||

| US456606JQ60 / INABS 2005-D M2 | 0,35 | 28,21 | 0,0604 | 0,0070 | |||||

| US83405Y1029 / SOFI PROFESSIONAL LOAN PROGRAM 2021-A TRUST | 0,35 | -9,37 | 0,0601 | -0,0150 | |||||

| US52521HAE36 / Lehman Mortgage Trust 2006-9 | 0,35 | -5,45 | 0,0600 | -0,0118 | |||||

| US73316PHR47 / Popular ABS Mortgage Pass-Through Trust, Class M1 | 0,34 | 2,40 | 0,0591 | -0,0063 | |||||

| US91680UAB52 / Upstart Pass-Through Trust Series | 0,34 | 200,88 | 0,0586 | 0,0391 | |||||

| Pagaya AI Debt Trust, Series 2024-1, Class C / ABS-O (US69548AAC53) | 0,34 | -15,08 | 0,0583 | -0,0195 | |||||

| XS2521608682 / RED & Black Auto Germany 9 UG | 0,34 | -5,35 | 0,0579 | -0,0115 | |||||

| XS2498923940 / Twin Bridges PLC, Series 2022-2, Class E | 0,33 | 7,62 | 0,0561 | -0,0030 | |||||

| US91683MAB00 / Upstart Pass-Through Trust Series 2021-ST9 | 0,32 | -4,14 | 0,0559 | -0,0102 | |||||

| Cherry SPV III (2023) LLC, Class B Facility / DBT (CHERRYMZ2) | 0,32 | 16,61 | 0,0546 | 0,0015 | |||||

| US00091HAC60 / ACC Trust 2022-1 | 0,32 | -13,22 | 0,0543 | -0,0165 | |||||

| Cherry SPV III (2023) LLC, Class B Facility / DBT (N/A) | 0,31 | 0,0526 | 0,0526 | ||||||

| US38144RAD98 / GSAA Home Equity Trust, Class A4 | 0,30 | 2,36 | 0,0524 | -0,0057 | |||||

| US73316PGL85 / Popular ABS Mortgage Pass-Through Trust, Class MF1 | 0,30 | 7,14 | 0,0517 | -0,0031 | |||||

| US92925CDC38 / WaMu Mortgage Pass-Through Certificates, Series 2006-AR3, Class A1C | 0,29 | 5,76 | 0,0508 | -0,0037 | |||||

| FR001400FVQ0 / FCT Autonoria DE 2023, Series 2023-DE, Class G | 0,29 | -3,92 | 0,0507 | -0,0092 | |||||

| FR001400FVL1 / FCT Autonoria DE, Series 2023-DE, Class F | 0,29 | -3,65 | 0,0501 | -0,0088 | |||||

| PTGAMIOM0024 / GAMMA Sociedade de Titularizacao de Creditos SA Consumer Totta 1, Series 2022-1, Class D | 0,29 | -3,65 | 0,0500 | -0,0089 | |||||

| US91679WAC29 / Upstart Securitization Trust, Series 2022-1, Class C | 0,29 | 3,24 | 0,0496 | -0,0048 | |||||

| XS2434408402 / Twin Bridges PLC, Series 2022-1, Class X2 | 0,28 | -20,96 | 0,0482 | -0,0208 | |||||

| US02151FAJ84 / Alternative Loan Trust, Series 2007-21CB, Class 2A3 | 0,28 | -12,34 | 0,0478 | -0,0140 | |||||

| OZLM XI, Ltd., Series 2017-11X, Class ER / ABS-CBDO (USG68688AE36) | 0,28 | -31,85 | 0,0477 | -0,0316 | |||||

| US14367RAJ77 / CARNOW AUTO RECEIVABLES TRUST 2023-1 CNART 2023-1A E | 0,26 | -10,85 | 0,0454 | -0,0124 | |||||

| US33844XAN84 / Flagship Credit Auto Trust, Series 2022-2, Class E | 0,26 | -12,16 | 0,0448 | -0,0130 | |||||

| US75115CAR88 / RALI Trust, Class 1A16 | 0,26 | -5,56 | 0,0440 | -0,0088 | |||||

| US91679WAB46 / UPSTART SECURITIZATION TRUST UPST 2022 1 B 144A | 0,24 | -38,18 | 0,0411 | -0,0340 | |||||

| FR00140048P8 / FCT Noria 2021, Series 2021-1, Class F | 0,24 | -4,42 | 0,0411 | -0,0076 | |||||

| IE0004514372 / BNY Mellon U.S. Treasury Fund, Institutional Class | 0,23 | -53,20 | 0,23 | -53,39 | 0,0405 | -0,0576 | |||

| AU3FN0076337 / Metro Finance , Series 2023-1, Class F | 0,23 | -7,91 | 0,0402 | -0,0094 | |||||

| US46640NAT54 / JPMBB Commercial Mortgage Securities Trust, Series 2013-C15, Class F | 0,23 | -42,57 | 0,0401 | -0,0388 | |||||

| ES0305565063 / Autonoria Spain 2021 FT, Series 2021-SP, Class G | 0,22 | -4,80 | 0,0376 | -0,0073 | |||||

| Reach ABS Trust 2024-1, Series 2024-1A, Class D / ABS-O (US75526PAD33) | 0,22 | -1,38 | 0,0372 | -0,0055 | |||||

| US83406T1025 / SoFi Professional Loan Program 2020-ATrust | 0,21 | 37,01 | 0,0364 | 0,0098 | |||||

| IT0005459265 / Golden Bar Securitisation Srl, Series 2021-1, Class E | 0,20 | -5,31 | 0,0339 | -0,0065 | |||||

| US91683NAB82 / Upstart Pass-Through Trust Series 2022-ST1 | 0,20 | 3.166,67 | 0,0339 | 0,0327 | |||||

| PTTGC7OM0005 / TAGUS - Sociedade de Titularizacao de Creditos SA/Ulisses Finance No. 2, Series 2021-2, Class F | 0,19 | -1,57 | 0,0325 | -0,0048 | |||||

| US059523BM15 / Banc of America Funding , Class CA8 | 0,19 | 30,07 | 0,0322 | 0,0042 | |||||

| PTTGUOOM0025 / TAGUS - SILK, Class D | 0,19 | -2,62 | 0,0321 | -0,0052 | |||||

| Compartment BL Consumer Credit 2024, Series 2024-1, Class X1 / ABS-O (XS2758922897) | 0,18 | -31,80 | 0,0307 | -0,0203 | |||||

| NYMTN / New York Mortgage Trust, Inc. - Preferred Stock | 0,01 | 0,00 | 0,17 | -3,89 | 0,0300 | -0,0054 | |||

| US83401A1088 / SOFI 2018 D R1 144A | 0,17 | 3,66 | 0,0294 | -0,0028 | |||||

| PTTGCMOM0011 / Vasco Finance, Series 2023-1, Class F | 0,17 | -4,07 | 0,0285 | -0,0051 | |||||

| PTTGCLOM0012 / Vasco Finance, Series 2023-1, Class E | 0,16 | -5,26 | 0,0280 | -0,0056 | |||||

| Bletchley Park Funding PLC, Series 2024-1, Class X1 / ABS-MBS (XS2850626321) | 0,16 | -34,45 | 0,0270 | -0,0195 | |||||

| US78471H1086 / SOFI 2019 A R1 144A | 0,16 | -6,63 | 0,0268 | -0,0056 | |||||

| Radnor Re, Ltd., Series 2024-1, Class B1 / ABS-MBS (US75049AAD46) | 0,16 | 1,31 | 0,0267 | -0,0031 | |||||

| US83406T1025 / SoFi Professional Loan Program 2020-ATrust | 0,15 | -27,70 | 0,0266 | -0,0150 | |||||

| US52606WAC29 / Lendingpoint 2022-B Asset Securitization Trust | 0,14 | -4,64 | 0,0249 | -0,0047 | |||||

| XS2398294814 / SCF Rahoituspalvelut X DAC, Series 2021-10, Class D | 0,14 | -8,97 | 0,0245 | -0,0060 | |||||

| US83405F1030 / SoFi Professional Loan Program , Series 2020-B, Class R1 | 0,14 | 0,00 | 0,0244 | -0,0033 | |||||

| Polaris PLC, Series 2024-1, Class X / ABS-MBS (XS2765489138) | 0,14 | -47,57 | 0,0242 | -0,0279 | |||||

| US33843WAL54 / FLAGSHIP CREDIT AUTO TRUST FCAT 2021 1 R 144A | 0,14 | -14,63 | 0,0242 | -0,0078 | |||||

| Finance Ireland RMBS NO 7 DAC, Series 2024-7, Class X / ABS-MBS (XS2837236822) | 0,13 | -49,61 | 0,0224 | -0,0280 | |||||

| Bain Capital Credit CLO 2018-2, Series 2018-2X, Class F / ABS-CBDO (USG07050AC44) | 0,13 | -19,62 | 0,0219 | -0,0091 | |||||

| US78471C1099 / SOCIAL PROFESSIONAL LOAN PROGR SOFI 2017 D R1 144A | 0,12 | -13,29 | 0,0214 | -0,0066 | |||||

| PTLSNYOM0000 / Ares Lusitani-STC SA / Pelican Finance 2, Series 2021-2, Class E | 0,12 | -3,20 | 0,0210 | -0,0035 | |||||

| US46648PAN50 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2017-FL11 | 0,12 | -5,56 | 0,0206 | -0,0041 | |||||

| US67111XAC65 / OZLM XXII Ltd | 0,12 | -39,49 | 0,0204 | -0,0178 | |||||

| US46591JAJ51 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-BKWD | 0,12 | -2,50 | 0,0203 | -0,0033 | |||||

| US91680UAB52 / Upstart Pass-Through Trust Series | 0,11 | -59,50 | 0,0195 | -0,0350 | |||||

| US17322YAP51 / Citigroup Commercial Mortgage Trust, Series 2014-GC25, Class E | 0,11 | -33,73 | 0,0194 | -0,0137 | |||||

| US69547JAC71 / PAID_21-1 | 0,11 | -22,46 | 0,0186 | -0,0085 | |||||

| US12668AA471 / Alternative Loan Trust, Class 1A17 | 0,10 | 0,99 | 0,0177 | -0,0022 | |||||

| US20824CAB19 / Conn's Receivables Funding LLC, Series 2023-A, Class B | 0,10 | -34,93 | 0,0165 | -0,0120 | |||||

| US02151FAK57 / Alternative Loan Trust, Series 2007-21CB, Class 2A4 | 0,09 | 38,24 | 0,0162 | 0,0028 | |||||

| FR0014004TK5 / FCT Pixel 2021, Series 2021-1, Class G | 0,09 | -13,33 | 0,0157 | -0,0048 | |||||

| US87330UAE10 / Taberna Preferred Funding II, Ltd., Series 2005-2A, Class B | 0,09 | -11,00 | 0,0155 | -0,0041 | |||||

| XS2643261337 / Dilosk RMBS, Series 2023-7, Class X1 | 0,07 | -13,92 | 0,0118 | -0,0037 | |||||

| US90355EAD31 / US Auto Funding, Series 2021-1A, Class D | 0,05 | -43,82 | 0,0088 | -0,0088 | |||||

| XS2399684815 / PBD Germany Auto Lease Master SA - Compartment 2021-1, Series 2021-GE2, Class F | 0,04 | -39,13 | 0,0073 | -0,0064 | |||||

| Newgate Funding PLC, Series 2006-2, Class DB / ABS-MBS (XS0257996073) | 0,04 | 7,89 | 0,0071 | -0,0004 | |||||

| US91680BAB71 / Upstart Pass-Through Trust, Series 2020-ST2, Class CERT | 0,04 | -66,02 | 0,0061 | -0,0142 | |||||

| US57108T1079 / Marlette Funding Trust 2021-2, Series 2021-2A, Class R | 0,03 | 3,03 | 0,0059 | -0,0006 | |||||

| AutoFlorence 2 Srl, Series 2021-2, Class F / ABS-O (IT0005456998) | 0,03 | -9,68 | 0,0050 | -0,0011 | |||||

| Brignole Co., Series 2024-2024, Class D / ABS-O (IT0005598385) | 0,01 | 0,00 | 0,0019 | -0,0001 | |||||

| Recv Irs 4.20 04/04/28 / DIR (N/A) | 0,01 | 0,0018 | 0,0018 | ||||||

| US69546T1025 / PAID_20-3 | 0,01 | -16,67 | 0,0018 | -0,0008 | |||||

| SWF Funding LLC, Loan Facility / DBT (N/A) | 0,01 | 0,0017 | 0,0017 | ||||||

| US91679VAB62 / Upstart Pass-Through Trust Series 2020-ST4 | 0,01 | 0,00 | 0,0016 | -0,0002 | |||||

| Recv Irs 4.058 04/04/30 / DIR (N/A) | 0,00 | 0,0002 | 0,0002 | ||||||

| Recv Irs 4.35 04/05/27 / DIR (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| US35729PEV85 / FHLT 2004-C M3 MTGE | 0,00 | 0,0000 | 0,0000 | ||||||

| JAAA / Janus Detroit Street Trust - Janus Henderson AAA CLO ETF | 0,00 | -100,00 | 0,00 | -100,00 | -4,8835 | ||||

| MARKIT CDX HY S43 5Y 2/29 ICE / DCR (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Markit CDX NA High Yield Index, Series 41 / DCR (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| REVERSE REPO / RA (N/A) | Short | -0,00 | -0,00 | -0,0002 | -0,0002 | ||||

| Recv Irs 4.2131 06/20/27 / DIR (N/A) | -0,01 | -0,0009 | -0,0009 | ||||||

| Receive SOFRRATE / Pay 3.63094% IRS 06/20/2032 / DIR (SWP363093) | -0,02 | -0,0036 | -0,0036 | ||||||

| Recv Irs 3.9657 06/20/30 / DIR (N/A) | -0,07 | -0,0119 | -0,0119 | ||||||

| REVERSE REPO / RA (RP0271946) | Short | -0,08 | -0,00 | -0,09 | 10,26 | -0,0149 | 0,0006 | ||

| RP5459265 / REVERSE REPO | Short | -0,12 | -14,56 | -0,14 | -6,80 | -0,0237 | 0,0051 | ||

| REVERSE REPO / RA (N/A) | Short | -0,17 | -0,17 | -0,0286 | -0,0286 | ||||

| REVERSE REPO / RA (RP679WAB4) | Short | -0,18 | -37,76 | -0,18 | -37,76 | -0,0307 | 0,0252 | ||

| Receive SOFRRATE / Pay 3.59039% IRS 06/20/2027 / DIR (SWP359039) | -0,21 | -0,0361 | -0,0361 | ||||||

| REVERSE REPO / RA (N/A) | Short | -0,23 | -0,23 | -0,0396 | -0,0396 | ||||

| RP115CAE7 / REVERSE REPO | Short | -0,24 | -7,06 | -0,24 | -7,06 | -0,0408 | 0,0089 | ||

| RP0250834 / REVERSE REPO | Short | -0,22 | 0,68 | -0,25 | 9,87 | -0,0423 | 0,0013 | ||

| REPO / RA (RP754DAJ6) | Short | -0,25 | -1,17 | -0,25 | -1,17 | -0,0438 | 0,0064 | ||

| REVERSE REPO / RA (N/A) | Short | -0,27 | -0,27 | -0,0457 | -0,0457 | ||||

| REVERSE REPO (MRA) / RA (RP161CAB4) | Short | -0,31 | -0,65 | -0,31 | -0,65 | -0,0527 | 0,0074 | ||

| REVERSE REPO / RA (N/A) | Short | -0,32 | -0,32 | -0,0548 | -0,0548 | ||||

| REVERSE REPO / RA (RP71XAH70) | Short | -0,33 | -0,33 | -0,0560 | -0,0560 | ||||

| RP673ZH84 / REVERSE REPO | Short | -0,34 | 1,80 | -0,34 | 1,80 | -0,0584 | 0,0066 | ||

| RP54BAN47 / REVERSE REPO | Short | -0,35 | -4,25 | -0,35 | -4,43 | -0,0596 | 0,0109 | ||

| RP41YAF97 / REVERSE REPO | Short | -0,35 | -1,98 | -0,35 | -1,98 | -0,0596 | 0,0093 | ||

| REVERSE REPO / RA (RP7683291) | Short | -0,31 | -3,30 | -0,35 | 5,76 | -0,0602 | 0,0044 | ||

| REVERSE REPO / RA (RP0778838) | Short | -0,27 | 8,28 | -0,35 | 16,45 | -0,0612 | -0,0016 | ||

| RP104QQ78 / REVERSE REPO | Short | -0,36 | 1,99 | -0,36 | 1,99 | -0,0619 | 0,0069 | ||

| REVERSE REPO / RA (RP683VAC8) | Short | -0,36 | 1,69 | -0,36 | 1,69 | -0,0622 | 0,0071 | ||

| RPUS12639 / REVERSE REPO | Short | -0,37 | -3,94 | -0,37 | -3,94 | -0,0631 | 0,0113 | ||

| REVERSE REPO / RA (N/A) | Short | -0,38 | -0,38 | -0,0646 | -0,0646 | ||||

| REVERSE REPO / RA (RP1816150) | Short | -0,34 | -5,49 | -0,39 | 3,19 | -0,0670 | 0,0066 | ||

| REVERSE REPO / RA (N/A) | Short | -0,39 | -0,39 | -0,0670 | -0,0670 | ||||

| REVERSE REPO / RA (RP0181319) | Short | -0,35 | -1,39 | -0,40 | 7,63 | -0,0682 | 0,0036 | ||

| RP5694053 / REVERSE REPO | Short | -0,35 | -1,50 | -0,40 | 7,61 | -0,0683 | 0,0036 | ||

| RP91VAE56 / REVERSE REPO | Short | -0,40 | -0,50 | -0,40 | -0,50 | -0,0684 | 0,0095 | ||

| REVERSE REPO / RA (RP88XAA00) | Short | -0,41 | 1,50 | -0,41 | 1,50 | -0,0698 | 0,0081 | ||

| REVERSE REPO / RA (RP1946724) | Short | -0,36 | -1,59 | -0,41 | 7,55 | -0,0712 | 0,0039 | ||

| REVERSE REPO / RA (N/A) | Short | -0,43 | -0,43 | -0,0748 | -0,0748 | ||||

| RP5694046 / REVERSE REPO | Short | -0,39 | -0,65 | -0,44 | 8,42 | -0,0756 | 0,0034 | ||

| RP2500384 / REVERSE REPO | Short | -0,33 | -0,38 | -0,44 | 7,00 | -0,0765 | 0,0044 | ||

| REVERSE REPO / RA (RP1075069) | Short | -0,33 | -6,89 | -0,45 | 0,23 | -0,0767 | 0,0101 | ||

| REVERSE REPO / RA (RP168AAG7) | Short | -0,45 | 2,03 | -0,45 | 2,03 | -0,0779 | 0,0086 | ||

| REVERSE REPO / RA (RP1815855) | Short | -0,34 | -2,41 | -0,46 | 5,08 | -0,0784 | 0,0063 | ||

| RP401NAQ2 / REVERSE REPO | Short | -0,47 | -3,09 | -0,47 | -3,09 | -0,0810 | 0,0137 | ||

| REVERSE REPO / RA (RP9459457) | Short | -0,43 | -0,49 | -0,0843 | -0,0843 | ||||

| REPO / RA (RP753ACF9) | Short | -0,51 | -1,55 | -0,51 | -1,55 | -0,0874 | 0,0132 | ||

| REVERSE REPO / RA (RP884AB18) | Short | -0,52 | -0,52 | -0,0903 | -0,0903 | ||||

| Receive SOFRRATE / Pay 3.57686% IRS 06/20/2030 / DIR (SWP357686) | -0,53 | -0,0917 | -0,0917 | ||||||

| REVERSE REPO / RA (RP8169068) | Short | -0,48 | -9,62 | -0,54 | -1,28 | -0,0928 | 0,0137 | ||

| Euro-BOBL Future / DIR (DE000F1B2NH5) | -0,54 | -0,0934 | -0,0934 | ||||||

| REVERSE REPO / RA (RP71NAH98) | Short | -0,54 | -0,54 | -0,0937 | -0,0937 | ||||

| REVERSE REPO / RA (RP589AAB5) | Short | -0,55 | -1,27 | -0,55 | -1,27 | -0,0941 | 0,0139 | ||

| REVERSE REPO / RA (RP7788382) | Short | -0,41 | -0,55 | -0,0951 | -0,0951 | ||||

| REVERSE REPO / RA (RP25HAD26) | Short | -0,55 | -0,55 | -0,0954 | -0,0954 | ||||

| REVERSE REPO / RA (RP092KAE4) | Short | -0,55 | -0,55 | -0,55 | -0,72 | -0,0956 | 0,0133 | ||

| RP121PAY9 / REVERSE REPO | Short | -0,56 | -3,61 | -0,56 | -3,61 | -0,0967 | 0,0170 | ||

| REVERSE REPO / RA (RP1695778) | Short | -0,42 | -63,38 | -0,56 | -60,68 | -0,0972 | 0,1825 | ||

| REVERSE REPO / RA (RP3164145) | Short | -0,43 | -0,58 | -0,0997 | -0,0997 | ||||

| REVERSE REPO / RA (RP0556131) | Short | -0,52 | -11,15 | -0,59 | -2,99 | -0,1009 | 0,0169 | ||

| REVERSE REPO / RA (RP57BAN91) | Short | -0,59 | -0,59 | -0,1010 | -0,1010 | ||||

| REVERSE REPO / RA (N/A) | Short | -0,59 | -0,59 | -0,1017 | -0,1017 | ||||

| RP68AAG76 / REVERSE REPO | Short | -0,59 | -1,17 | -0,59 | -1,17 | -0,1018 | 0,0149 | ||

| CXNY8QW00 / MARKIT CMBX NA BB S15 11/64 OTC | -0,60 | 31,28 | -0,1028 | -0,0140 | |||||

| REVERSE REPO / RA (RP7421431) | Short | -0,45 | -5,33 | -0,60 | 1,69 | -0,1037 | 0,0118 | ||

| REVERSE REPO / RA (RP7534521) | Short | -0,53 | -0,04 | -0,60 | 9,22 | -0,1042 | 0,0040 | ||

| REVERSE REPO / RA (RP57JAQ58) | Short | -0,61 | -0,61 | -0,1051 | -0,1051 | ||||

| REVERSE REPO / RA (RP35AAE82) | Short | -0,62 | -0,62 | -0,1071 | -0,1071 | ||||

| REVERSE REPO / RA (N/A) | Short | -0,64 | -0,64 | -0,1103 | -0,1103 | ||||

| REVERSE REPO / RA (RP955AD13) | Short | -0,66 | -0,66 | -0,1138 | -0,1138 | ||||

| REVERSE REPO / RA (RP688LAE3) | Short | -0,69 | 0,14 | -0,69 | 0,14 | -0,1193 | 0,0157 | ||

| Markit CMBX BB Index, Series 14 / DCR (CXNP9U6H0) | -0,70 | 19,25 | -0,1207 | -0,0058 | |||||

| REVERSE REPO / RA (RP07KAJ60) | Short | -0,70 | -0,00 | -0,70 | 0,00 | -0,1212 | 0,0161 | ||

| REVERSE REPO / RA (RP17CAE12) | Short | -0,71 | -0,71 | -0,1224 | -0,1224 | ||||

| REVERSE REPO / RA (RP5561300) | Short | -0,63 | -0,71 | -0,1228 | -0,1228 | ||||

| REVERSE REPO / RA (RP48MAA36) | Short | -0,72 | 1,13 | -0,72 | 1,13 | -0,1239 | 0,0149 | ||

| REVERSE REPO / RA (N/A) | Short | -0,73 | -0,73 | -0,1256 | -0,1256 | ||||

| REVERSE REPO / RA (N/A) | Short | -0,73 | -0,73 | -0,1258 | -0,1258 | ||||

| RP25SAG12 / REVERSE REPO | Short | -0,74 | 1,65 | -0,74 | 1,65 | -0,1275 | 0,0146 | ||

| RP166BAG7 / REVERSE REPO | Short | -0,77 | 2,53 | -0,77 | 2,53 | -0,1329 | 0,0140 | ||

| RP493HAQ8 / REVERSE REPO | Short | -0,78 | -5,10 | -0,78 | -5,13 | -0,1338 | 0,0260 | ||

| REVERSE REPO / RA (RP9503816) | Short | -0,70 | -0,32 | -0,79 | 8,82 | -0,1363 | 0,0056 | ||

| RP31BAB71 / REVERSE REPO | Short | -0,79 | -0,88 | -0,79 | -0,87 | -0,1367 | 0,0196 | ||

| Recv Irs 4.0822 06/20/28 / DIR (N/A) | -0,80 | -0,1385 | -0,1385 | ||||||

| REVERSE REPO / RA (RP548QAB2) | Short | -0,87 | 2,36 | -0,87 | 2,36 | -0,1492 | 0,0160 | ||

| Recv Irs 4.108 04/04/29 / DIR (N/A) | -0,89 | -0,1527 | -0,1527 | ||||||

| REVERSE REPO / RA (RP9504038) | Short | -0,80 | 3,72 | -0,90 | 13,28 | -0,1558 | 0,0001 | ||

| REVERSE REPO / RA (RP48QAA40) | Short | -0,91 | 1,25 | -0,91 | 1,23 | -0,1566 | 0,0186 | ||

| REVERSE REPO / RA (RP87WAG50) | Short | -0,93 | 2,43 | -0,93 | 2,43 | -0,1601 | 0,0170 | ||

| REVERSE REPO / RA (RP533NAE4) | Short | -0,93 | -0,93 | -0,1604 | -0,1604 | ||||

| REVERSE REPO / RA (N/A) | Short | -0,94 | -0,94 | -0,1615 | -0,1615 | ||||

| REVERSE REPO / RA (RP91LAA70) | Short | -0,99 | -0,99 | -0,1713 | -0,1713 | ||||

| REVERSE REPO / RA (RP47GAA76) | Short | -1,05 | -1,05 | -0,1809 | -0,1809 | ||||

| REVERSE REPO / RA (N/A) | Short | -1,07 | -1,07 | -0,1839 | -0,1839 | ||||

| REVERSE REPO / RA (RP28GAN25) | Short | -1,12 | -1,12 | -0,1923 | -0,1923 | ||||

| REVERSE REPO / RA (RP9504541) | Short | -1,07 | 11,68 | -1,22 | 21,94 | -0,2098 | -0,0149 | ||

| REVERSE REPO / RA (RP4989918) | Short | -0,91 | -1,62 | -1,22 | 5,73 | -0,2101 | 0,0150 | ||

| US 10Yr Note Future / DIR (N/A) | -1,23 | -0,2127 | -0,2127 | ||||||

| RP161AAB8 / REVERSE REPO | Short | -1,24 | -3,28 | -1,24 | -3,28 | -0,2137 | 0,0366 | ||

| REVERSE REPO / RA (RP17CAD39) | Short | -1,26 | -1,26 | -0,2168 | -0,2168 | ||||

| REVERSE REPO / RA (RP6256709) | Short | -0,95 | -0,30 | -1,26 | 7,14 | -0,2172 | 0,0125 | ||

| REVERSE REPO / RA (RP9458566) | Short | -1,12 | -1,27 | -0,2194 | -0,2194 | ||||

| Markit CMBX BBB- Index, Series 15 / DCR (N/A) | -1,29 | -0,2224 | -0,2224 | ||||||

| REVERSE REPO / RA (RP9459028) | Short | -1,22 | -1,39 | -0,2388 | -0,2388 | ||||

| RP43XAG43 / REVERSE REPO | Short | -1,47 | -0,54 | -1,47 | -0,54 | -0,2526 | 0,0352 | ||

| REVERSE REPO / RA (RP9458723) | Short | -1,47 | -1,67 | -0,2878 | -0,2878 | ||||

| REVERSE REPO / RA (RP548AAE1) | Short | -1,68 | 1,76 | -1,68 | 1,75 | -0,2899 | 0,0329 | ||

| REVERSE REPO / RA (RP4960AE5) | Short | -1,68 | 0,98 | -1,68 | 0,96 | -0,2903 | 0,0354 | ||

| REVERSE REPO / RA (RP54GAJ94) | Short | -1,80 | 0,78 | -1,80 | 0,78 | -0,3107 | 0,0386 | ||

| REVERSE REPO / RA (RP46VAC19) | Short | -1,84 | -0,16 | -1,84 | -0,16 | -0,3164 | 0,0427 | ||

| REVERSE REPO / RA (RP47UAD00) | Short | -1,93 | 0,16 | -1,93 | 0,16 | -0,3319 | 0,0436 | ||

| REVERSE REPO / RA (RP9839855) | Short | -2,03 | -2,30 | -0,3968 | -0,3968 | ||||

| REVERSE REPO / RA (RP4151436) | Short | -2,15 | -2,86 | -0,4936 | -0,4936 | ||||

| SWEDISH KRONA FUT Jun25 / DFE (N/A) | -3,32 | -0,5730 | -0,5730 | ||||||

| AUD $ Currency Fut / DFE (N/A) | -5,45 | -0,9385 | -0,9385 | ||||||

| US 5Yr Note Future / DIR (N/A) | -11,14 | -1,9194 | -1,9194 | ||||||

| US 2Yr Note Future / DIR (N/A) | -15,40 | -2,6544 | -2,6544 | ||||||

| BP Currency Future / DFE (N/A) | -38,02 | -6,5529 | -6,5529 | ||||||

| Euro FX Currency / DFE (N/A) | -63,30 | -10,9089 | -10,9089 |